Once outliers, incumbent US retail pharmacy chains have spent the last 6 years manoeuvring into position as the lynchpin for the Quadruple Aim.

Given the complex make-up of the US Healthcare system, this has been no mean achievement, and should be applauded. Yes, the market is large enough to keep attracting new players looking to disrupt primary care, such as Babylon Health. But Retail Pharmacy already enjoys a solid footprint across all US States, with a rich heritage of customer loyalty.

Its leaders have evolved to the point where advancing deeper into the Healthcare stack with a well-rounded primary care offer makes so much sense.

Transformation and the Order of Competitive Play

We talk about Transformation, Digital Transformation, and Disruption as if organizations are hard wired to know when and how to ‘do’ this.

The Retail Pharma sector is transforming and disrupting, with success stories to share. Its leaders have always understood that:

- They as incumbents must disrupt beyond their installed base of customers. They haven’t deviated from their core mission – to support under-served communities – yet their strategic announcements through 2022 align to the fact that so many more US citizens fall into this category of ‘unsupported at different stages of their wellness and health;

- Disruption generates growth – ‘going digital’ doesn’t;

- To disrupt, you first have to define your future today, despite market uncertainties and flux, and prepare every area of your business to pursue this. This may seem counter-intuitive, but by using insight to keep track of headwinds and tailwinds, vision and strategy are better informed, and take out guess work or reliance on intuition.

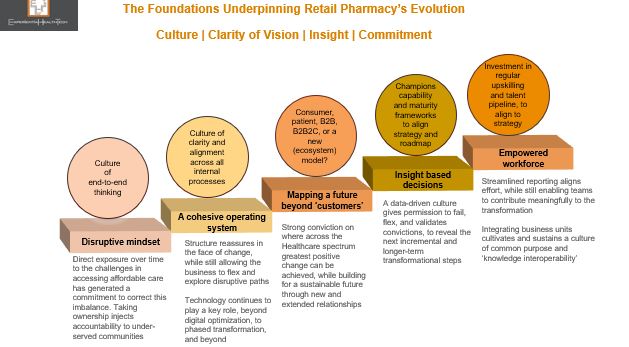

Culture| Clarity of Vision | Insight| Commitment

There are very clear characteristics that set successful companies apart, in any sector. Above all else, the old adage about culture still rings true. Culture is their compass, barometer, and altimeter all in one. Once an organisation agrees its vision and the scale of transformation needed to deliver, culture keeps leaders and the workforce aligned.

Successive Retail Pharmacy leaders within each of the leading 3 US players – CVS, Walgreens, and Walmart – honour these principles.

They are champions of end-to-end thinking: Setting a vision that extends beyond 10 years; being comfortable with not having all the answers up front, yet identifying the customer of the future they want to support, through new service models. Ironically, this mindset is interdependent on openness and evolution, where collaborative solution-building becomes the norm.

Transformation is by nature complex and can never be considered complete. Organisations need a balance of yin and yang to ensure structure and pace. That translates as driving through an internal operational overhaul, to ensure watertight efficiency. This in turn facilitates a meaningful value proposition for the market. In the case of Retail Pharmacy, all roads need to lead to value based care, underpinned by outcomes.

But there are cautionary notes:

- Given the installed bases at stake, at-pace scaling mustn’t compromise patient safety. Some investigative reports in the US (outside my remit) claim intense KPI metrics have led to multiple cases of prescribing admin errors. As Europe (currently a digital laggard) gears up for ePrescribing, this aspect will be scrutinised. Trust is precious;

- Both Walgreens and Optum Group (now a partner of Walmart) claim to be payor agnostic and champion equity, but have yet to truly reset the status quo on transparency and out-of-pocket expenses. Meanwhile, note the growing momentum behind the much smaller @RosettaHealth and its evidenced framework, delivering eye-watering savings for members.

Insight is Our Oxygen Through Transformation

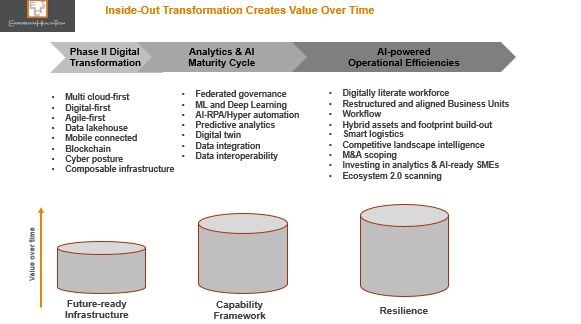

Insight, based on good data, validates effort when we see small and ongoing positive outcomes. It keeps an organisation’s workforce and partners close to its mission. Analytics and AI-driven insight is intertwined with Transformation.

Experiential HealthTech defines AI in today’s market context as Augmented Intelligence. This not only reflects the capability maturity across Healthcare – embryonic – but also re-enforces that AI will remain a blend of machine and human interaction. This is vital across Healthcare, which needs to keep high touch contexts- as far as resourcing permits.

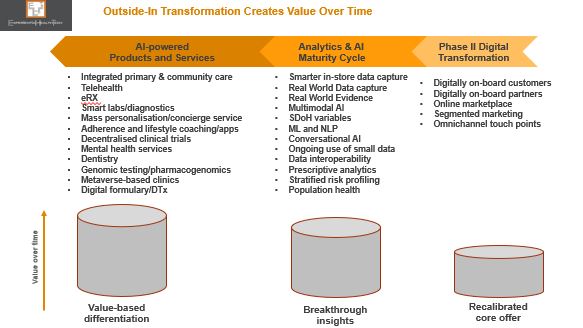

The analytics and AI maturity cycles at operational and market-facing levels are broad, and the pace and scale at which Retail Pharmacy organisations are working through these are dictated by their internal reconfigurations and partnerships.

Throughout the COVID pandemic, one thing became clear: there were petabytes of untapped rich data across Retail Pharmacy. And like other organisations already on a transformation path, radical effective responses could be accelerated, with confidence.

This success will likely have altered Retail Pharmacy incumbents’ next phase priorities: while a degree of competitive overlap remains across their roadmaps, there are also liberal doses of ‘dare to imagine’, with ambition flagged against decentralised clinical trials and pharmacogenomics.

Technology and Digital Blend

Tech partnerships have proved and remain invaluable to Retail Pharmacy. The collaborations being signed, to ensure ongoing enterprise and analytics/AI maturity, showcase how some ‘big’ players are comfortable carving a future-state based on value-driven partnerships and knowledge sharing, rather than ‘fixing’ Healthcare with a land grab. Nor are these retailers insisting on exclusivity – Microsoft, for example is supporting more than one with their ongoing transformation.

These are just some of the few currently supporting the sector.

Healthtech SMEs and AI

SMEs in the form of biotechs, virtual care , and digital therapeutics specialists are contributing significantly across Healthcare. Some embed analytics and other AI modes as a competitive differentiator from Day 1. Many haven’t even started along this road. And yet they must, because we need to end up with SMEs that are part of a wider contribution to society, supporting real world need, workflow and other processes. Point solutions help no-one.

For that reason, the interlinking internal and market facing transformation phases outlined above are just as relevant for them.

Retail Pharmacy leaders’ vision does include greater collaborative SME ventures, but for the moment risk is largely managed and weighted within VC funding, or support to modernise the SME operation as a future-proof.

As their market facing services portfolio continues to evolve and augment the Healthcare-at-Home vision, I expect to see a wide range of SME-related announcements:

- CVS, for example, continues to back analytics and virtual care specialist Biofourmis (Series D) – and so a multimodal AI focus may yet emerge to align with CVS’ direction.

- In India, Walmart is training 5,000 micro and SMEs (micro enterprises are the backbone of the Indian economy) over a 5-year period. Participants will have access to advanced business tools and advisory support to grow their offline and online businesses. There is an additional potential to advance and gain accreditation through the Walmart marketplace.

This isn’t about conquering: it is about broadening the spectrum of affordable choice, equity, and bridging more of the chasms across the Healthcare system, to enhance local population health. Good data and the power of outreach will remain critical levers. (smaller) Peers elsewhere can copy aspects of this model to start out on their own Transformation.

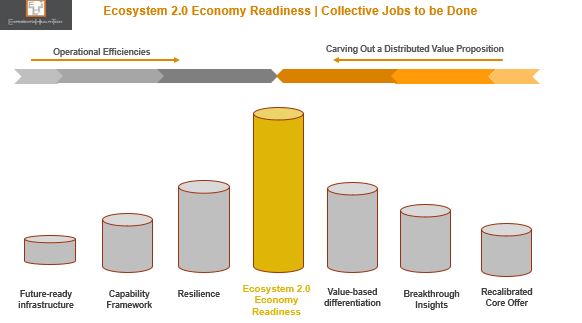

The Ecosystem 2.0 Economy Beckons

I believe the greatest breakthrough in the US initially will come from a willingness to forge a new model – based on Ecosystem 2.0 – which as composite organisations these 3 US players could orchestrate or contribute to, when the time is right.

In the meantime, the new relationships being forged with payors and their provider networks, Pharma, and SMEs bode well.