‘Jobs to be done’ will dominate the NHS 2023/24 radar: Clear outcomes; RoI; More of what has supported successful delivery. Tech to underpin weak foundations, boost efficiency, empower.

A tall order, given the new regional Integrated Care Systems (ICS) cluster model is still bedding down. But post pandemic, buyers better appreciate their tech assets. They have a greater awareness of the futility of point solutions, and need for aligned tech and digital investment.

The North Star aspirations don’t disappear, but are de-escalated in the face of more frontline mission critical needs. They’ll also face competition for available budget. The strongest demand potential will come from so-called ‘Arms Length Bodies’ (ALBs) such as the new NHS Transformation Directorate (the merger of NHS England, NHS Digital, and Health Education England), given their remit on national-level futureproofing. However, growth opportunities may be confined to vendor relationships forged through the pandemic.

An NHS Digital Maturity Framework Remains Elusive For Now

If you’re a vendor of US origin, you will likely have been reassured by the partnership between HIMSS and NHS England to co-design a digital maturity assessment framework – recognised internationally, HIMSS provides a solid benchmark on which to pursue and measure excellence. It also helps providers (aka Trusts) to align their investments.

That partnership has been dissolved, with consultancy McKinsey recently awarded a 2-3 year contract to deliver a baseline and an enhanced assessment of maturity across NHS providers and ICSs. Seven pillars will underpin: ‘well-led; smart foundations; safe practice; support people; empower citizens; improve care; and healthy populations’.

NHS England has made several attempts at such an assessment in recent years, yet has achieved very little to-date.

Clearly no-one can wait until this latest project takes off. Common sense alone indicates that maturity levels across ICSs still vary considerably, and will do so beyond 2023. While ambitious and well-led providers have always mapped out their own trajectory, and had the funds to support this, 2023/24 is all about coming together as a local geographic ICS cluster, to audit, streamline, and map immediate priorities.

That of course doesn’t mean that these ambitious providers will stall their strategy while others play catch up. This is an ongoing tension that ICS leaders and their Boards will have to manage.

One Provider’s Innovation is Another’s Foundation

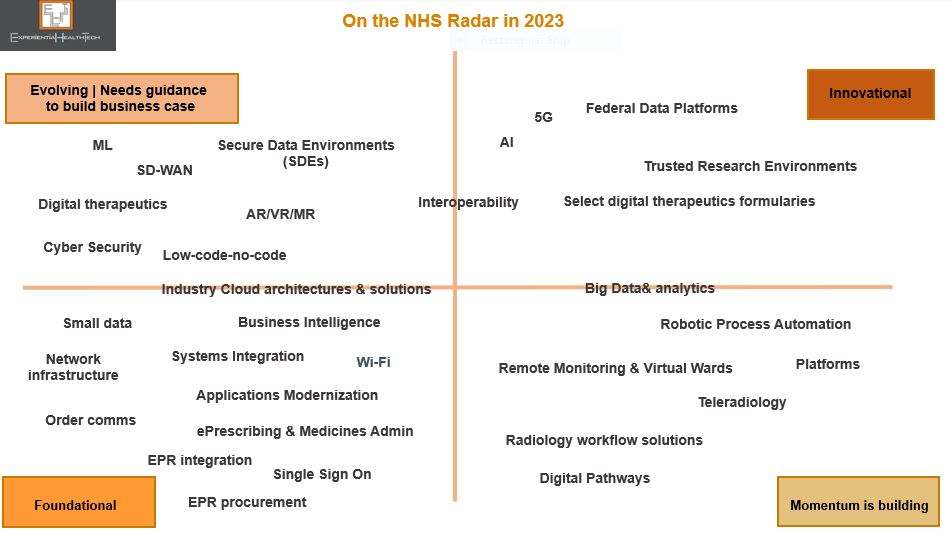

To support vendors on where to direct their effort through 2023/24, Experiential HealthTech has mapped out which digital and technology areas are high priority, and therefore most likely to attract available budget.

These priorities are grouped across four categories, to reflect both the disparity in maturity levels at individual provider level, and the greater need to align capability and ambition at ICS level. The technologies listed below are not exhaustive. We are not implying that tech procurement teams will move in linear fashion from one category to another.

This selection also chimes with those frontline operational targets we believe to be of highest collective priority in 2023: earlier diagnosis, referrals, co-ordinated pathways, patient flow, remote monitoring, and workforce management.

- Foundational: Providers at this level are largely playing catch up. Note that dozens have yet to deploy an EHR. Amongst those that do have one, order comms modules may not necessarily be in scope. A lack of modern Wi-Fi infrastructure clearly stalls new OOH models of care and inhibits patient-centric services. Cloud may or may not be deployed – the most likely exposure will be through EHR vendors. Even instances of small data may be alien to many clinical and admin teams at this level;

- Momentum is building: Providers making investment decisions at this level have already taken successful steps towards more co-ordinated care, and are looking to replicate early wins, to perhaps address co-morbidity. In these contexts, workflow and patient flow are being prioritised. Recognised gains also include richer data collection at a clinical and operational level;

- Evolving | Needs guidance to build business case: More mature providers are looking to align and advance their ambition through deployment of these technologies. They may either be aware of peer success in these domains, or feel these to be a next natural transformative step. Either way, they’ve reached the stage where they need support on relevant metrics to include to present their case to the C-Suite;

- Innovational: Those individual providers or ICS clusters poised to take evolutionary steps towards more of an ecosystem model, where interoperability is understood, data maturity comparatively high, R&D relationships a part of their remit, and more widely shared governance is culturally appreciated.

The opportunity for you lies in deciding which part of the maturity spectrum you want to support. Each category above offers scope for elasticity on which tech is deployed, so ground your value proposition. Be specific. Meet their goals. Ditch generic promises. Your ability to adapt is key.

At an ICS cluster level, expectation and need converges in relation to data & literacy, cloud, cyber, automation, and integration. User and IT team experiences so far have been mixed, partly through some vendor hype, so step up support for more granular roles-based education, transparent pricing advice, modernization, and workload migration.

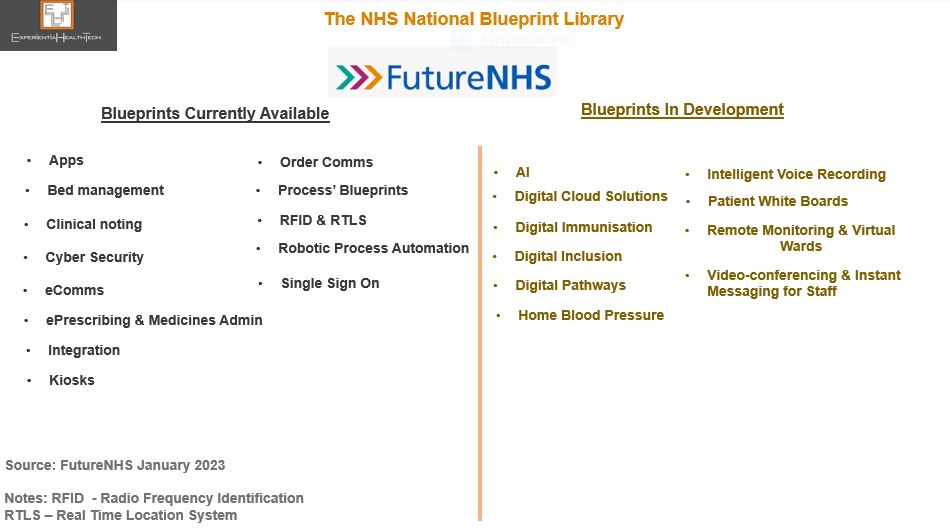

Also worth bearing in mind is the growing peer-to-peer influence via the NHS Blueprints (managed by FutureNHS). Published by providers that have successfully modernised and transformed, they are granular best practice guides. Not all of these blueprints are glamorous, but they clearly illustrate the power of peer influence and gap in transformation and modernisation that’s still out there.

More ambitious tech deployment guides are in the pipeline (see below). Aim to tie in your poster clients here, in context.

One important point to note at this stage is that ICSs are not yet empowered to buy tech and digital as a single buying unit.

Acute care remains the most lucrative demand path, in terms of direct spend, its role as clinical lead on new service models, or partnerships with Life Sciences. Mental health and community less so. Private providers will extend their remit to reduce the NHS frontline backlog, but digital maturity varies greatly here too. GPs are in flux. Social care has yet to line up.

Note that the time to impact buying decisions is shorter this 2023/24 Financial Year, since we have the certainty of a general election by year-end 2024 latest. This mandates a Purdah period, banning new spend from when the election date is announced, until the elected government is in place. That can eliminate six months of activity.

Vendor-Side Jobs to be Done

This ‘sleeves rolled up’ approach applies equally to you the vendor community. Competition continues to intensify, but that doesn’t necessarily reflect a sell-side completely aligned to real world demand.

Incumbents, especially within the clinical software side, continue to add more bells and whistles as a competitive response, without addressing the many enforced workarounds needed to overcome current solutions failings.

Use your current internal cost cutting measures to trigger a reset of priorities, with your partners in tow. Be realistic.

Your pre-sales teams should expect to have to graft harder to qualify leads. Account Managers will need to dig deeper on core and aligned need.

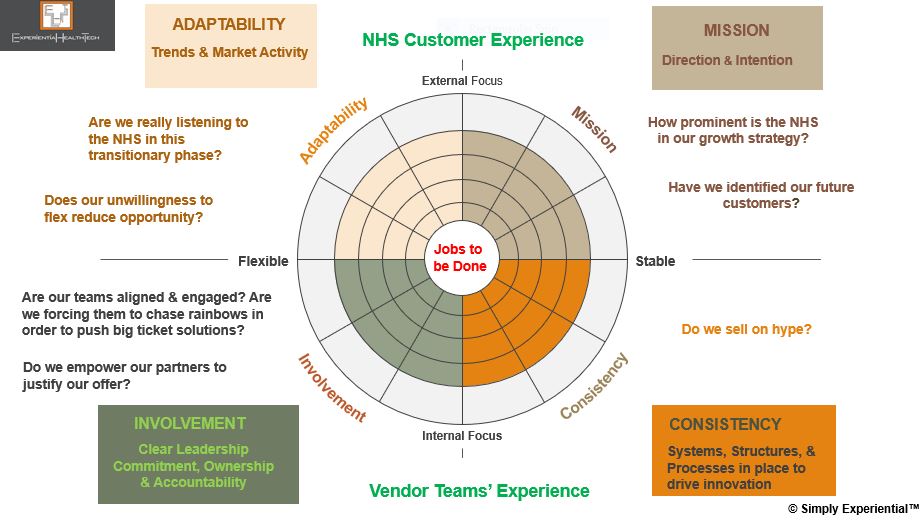

Simply Experiential™ | A Framework for Vendors and Their Partners

Below are the first-tier components of the Simply Experiential™ framework, which I use with my clients to review the impact of their internal operations on their market success today, as well as their robustness for future-mapping.

It’s a really useful way to bring often disparate teams together, to touch base, strategize, and plan together more effectively.

Your teams and partners explore their beliefs and assumptions about your culture, intention, and context in the market, and assess the spectrum of your capability now and in the future.

While health tech buyers certainly value culture, their loyalty is gained more through a deep-seated commitment to understanding their need at a granular level. Bear in mind that while the vendor and SME community believe they already show this, many experiences shared from across the NHS provider community reveal disconnect, disappointment, and hollow promises.

The framework has more detailed layers, and offers the ability to either hone-in on a specific area that needs to be addressed, or use it to baseline your next steps considerations. Think of it as an anchor to your strategic backbone.

The Bottom Line

The NHS will remain a tough sell in 2023/24. Not all wish lists will be fulfilled. But the tide is turning. With an upcoming general election, it’s natural to anticipate yet further government-led reorganization, especially should a new party get elected into power.

Should the ICS model not survive in name post-2024, its mission will – the NHS has come too far. It’s the many iterations and redesigns over the last decade that have brought the NHS in England to this point. Shaky as it may seem, it’s the best strategic steer we’ve seen, and continues to hold promise.

Effort committed now across your teams will lay down the marker for a greater dividend in the mid-term opportunity pipeline.