Once a health tech product or solution has been delivered to market its fate is arguably sealed.

You may have identified the gap or the problem to solve, but did you have the right team in place to constructively challenge your proposition, to ensure that what you’re bringing to market is actually valuable?

Competitive pressure can lead to behind the scenes airbrushing or scrimping, in the rush to ‘differentiate’. Reality eventually catches up, and reveals too many products have become obsolete, considered by users to be irrelevant, cumbersome to use, or over-engineered.

One tried and tested approach to ensuring you minimise the risk in getting it wrong is the product and platform-led growth model (PLG). An increasing number of successful health techs have adapted and refined this model on their own terms, at different stages in their growth. And we see that it continues to serve them well in both their portfolio and geographic footprint expansion.

If ever there was a more compelling GTM blueprint to consider this is it, especially as enforced cost cutting measures show no signs of ending across health tech.

Taking Stock

PLG is appropriate for vendors of all size. Incumbents may have to implement widespread transformation to accomplish it, while SMEs looking to scale may already have some elements in place. It’s arguably essential in any post M&A scenario.

At face value PLG seems simple. But it’s not.

It forces you to dismantle your internal approach to product design, sales, marketing, and GTM strategy. Out are hierarchies, in is empowerment.

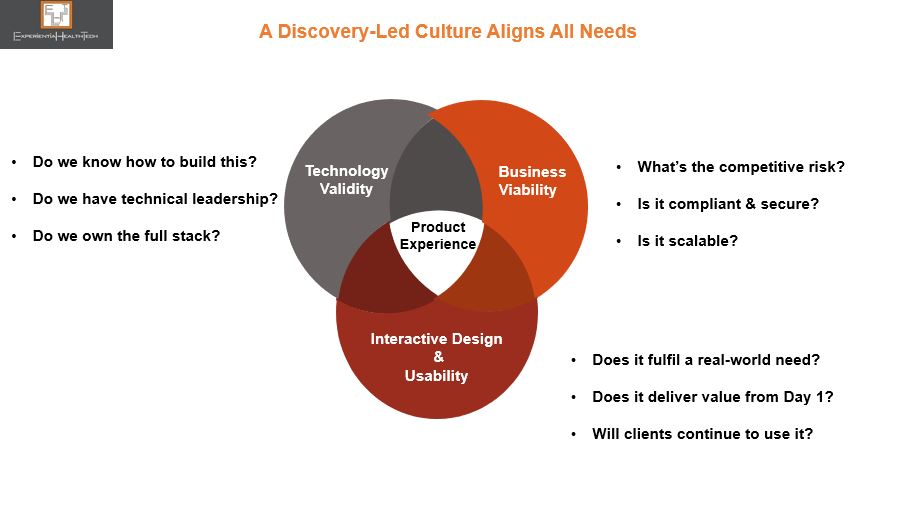

Firstly, the ‘product’ component is a misnomer. Across Healthcare we’ve endorsed the ‘product fit’ context. But PLG insists that client-side, your product must deliver tangible outcomes post-implementation. But that doesn’t mean ‘product first’ at all costs, especially to your business. Get this wrong and you have every other team running down the wrong track.

You need to consider the alignment between your intended product and your overall business and bottom line, as well as that of your partners. That means a series of ongoing checks and balances, treading fine lines on a number of fronts along the way.

Your ultimate goal is to get your product in front of real users, not buyers, who often have a different set of priorities. Their positive experiences can go viral and act as a gateway into their peer networks. Hope or assumption as a strategy won’t get you there.

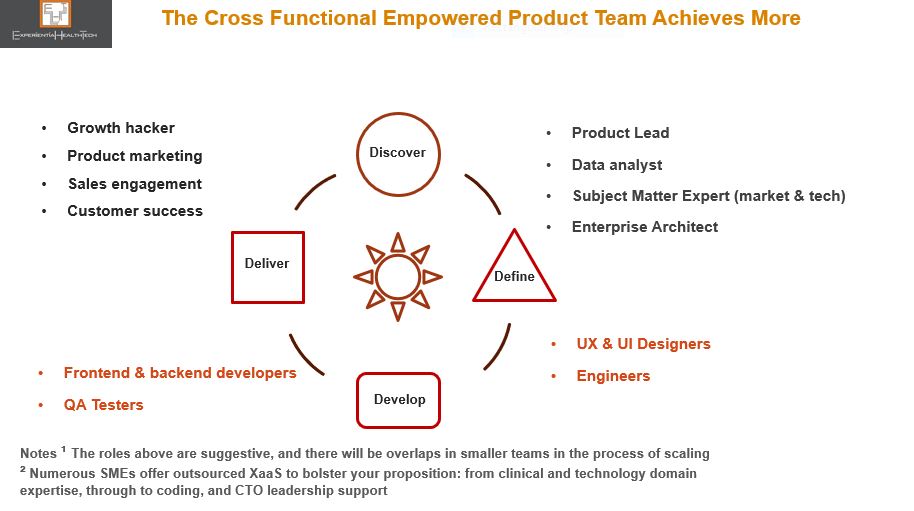

Setting Up Your ‘A’ Team Through (Re) Discovery

PLG elevates the ‘Discovery’ phase to centre stage. Product teams get to act as proactive influencers in the overall company strategy and vision. They get room to breathe through this phase, alongside a range of cross-functional experts from your other teams, brought in to contribute to this early stage. This bottom-up approach authorises product leaders to overwrite or dismiss a top-down push for features or short-term thinking.

This sets a commitment to and among your teams, as well as the market: a culture of more balanced opportunity scoping generates a viable proposition that speaks to your organisation’s strengths, and makes sense for you to pursue. Discovery helps define your USP and keep it centre stage.

The best analogy is to think of the flywheel, where core strength is enhanced when more aligned force is applied to keep the wheel in motion and prevent it from derailing. Underpinned by mutual respect, accountability, all incentives are reset to new metrics.

Post-delivery, client relationship management obviously comes to the fore. And PLG also rewrites this remit.

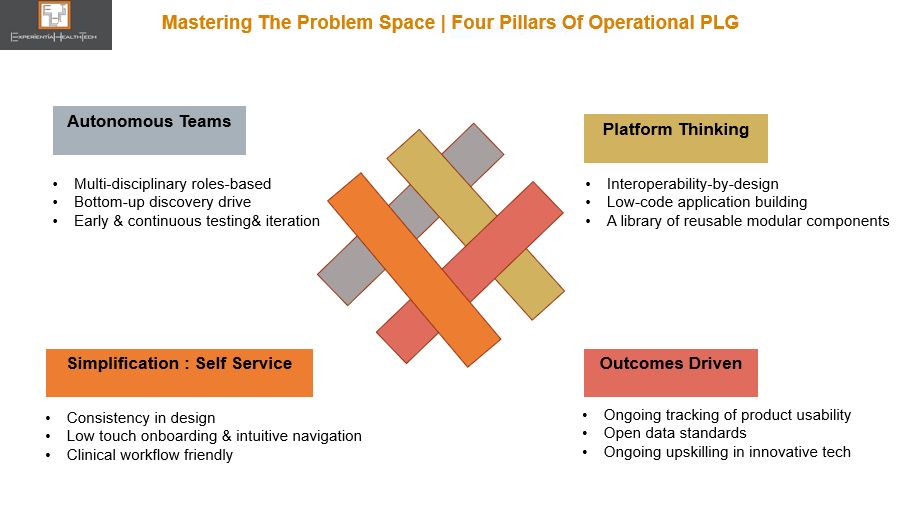

Your Cultural and Operational ‘Shift Left’

The cross-functional culture seeded through Discovery now extends across your lines of business, further empowering all your teams to keep delivering value.

By embracing platform thinking, you form a series of small teams with the authority to work together continually to oversee these areas: core IT capabilities; business capabilities; and customer journeys. Modularity is the glue that binds.

Together they navigate the layers of product strategy, business case analysis, demand forecasting, product-led growth tactics, your ongoing investment in technology, and end user validation. These are your under-writers, keeping you grounded.

And by keeping your fly wheel well oiled, the portfolio you offer has greater potential to serve new customers in adjacent healthcare sectors and new geographies.

Your new proposition will now embody these features:

- The art of listening: Your sales teams will remain ‘customer obsessed’, but will no longer this pressure your product teams into a conveyer belt of new features, or constant tweaks to customise.

Working alongside your product and engineering teams, they appreciate the power of pre-configured or modular solutions, and how this can actually help achieve superior outcomes.

- The ‘why’ not the ‘what’: How it helps, not what it does. Storytelling can weave rich examples of inspired actions from peers achieved pragmatic, innovative outcomes. Case studies can be effective in highlighting outcomes to your technically geared audience.

Consistency in design: Helps your clients eradicate variation across their workflows. Building standardization into your processes still leaves scope to creatively address local needs.

- The power of data: Analytics captured contextually reduce the need for hard intrusive selling and indirect user feedback. Customer Success and Product Marketing can focus on nurturing customers with higher lifetime values. Data driven insight also supports richer storytelling.

If you’re sceptical about this, then ask yourself: Why we still have so much shadow IT, incumbent solutions dripping in bells-and-whistles add-ons, or so many point solutions across Healthcare? Something has got lost in translation.

For reference, these health techs examples are testament to the power of PLG.