The race among vendors to offer Generative AI may look like commercial FoMO. But within Healthcare and Life Sciences (HLS) a measured modest approach is unfolding.

Continue reading “Generative AI in HLS | Open to Interpretation”Converged Healthcare and Life Sciences in 2030 | Scenario Planning

With no end in sight to the tumult gripping markets, trying to ringfence global directional trends across Healthcare and Life Sciences (HLS) in 2023 is pointless. Scenario planning offers a comparatively better grounding than demand forecasts.

You may feel immune to the course corrections underway within tech innovation circles: the 5G underwhelm; wearables overload; metaverse retreats; SPAC cash crunches; Prescription digital therapeutics (PDTx ) hurdles; generative AI landing out of left field, igniting overnight euphoria.

So what, you say, we operate in the heritage end of the clinical spectrum. And since linear decisions about tech and digital procurement across HLS are atypical, our strategy remains sound enough overall to carry on. It may take longer, but we’ll get there.

You may end up wrong footed. Relying on a single customer base, however compelling your proposition, increasingly leaves you vulnerable to a ‘must win at all costs’ culture, blinkered to alternative routes to market.

The Need for Transformation Finally Dawns

Particularly since Q4 2022 we’ve seen a raft of strategic moves from across HLS: restructuring; C-Suite flush outs; portfolio reworks; unlikely partnerships.

More incumbent providers and life sciences organizations are finally acting on what they’ve known for some time: they cannot singlehandedly offer the end-to-end contexts patients need; and that they must commit to full throttle transformation, or risk disintermediation. For some, there is a lot at stake over the next 5-7 years in relation to R&D, next generation intervention, and commercialization.

In contrast, the pioneering health techs and retail pharmacy go from strength to strength. The strategic investments they committed to as far back as 10 years ago are delivering yet more new service lines, geared to precision.

We’re now seeing credible moves towards end-to-end services in multiple contexts. But this time around there is no competitive land grab. The successful disruptors are already finding ways to innovate with and from inside the HLS system, to work with incumbents to remove friction points.

Convergence Will Underpin The New World Order

And there’s more on the horizon. Convergence is the ultimate target outcome. I dedicated my 2022 predictions to the theme of convergence, underpinned by four interrelated themes:

Strategic Orchestration : Extending the multi-disciplinary and hybrid- capability model across secondary care and its adjacent sectors. This is now also impacting primary care

- The Power of One : Cross-functional teams need a common data infrastructure that aligns to their inter-operational evolution

- The Curated Experience : The dawn of truly targeted intervention and therapeutics

- Ecosystem 2.0 : The composable-principled ecosystem that can support Healthcare and Life Sciences to align, empower, and transform is only starting to emerge.

I believe that much of what’s currently playing out validates this new foundational model.

Scenario Planning In a Nutshell

Deciding where you (re)position gets more critical with each passing year, as buying power shifts, different services skills are sought, and managed contracts face greater scrutiny.

By considering a range of plausible (but not certain) scenarios, based on market signals of varying strength, you create space for your teams to craft future states, both positive and negative.

Interpreting The Signals

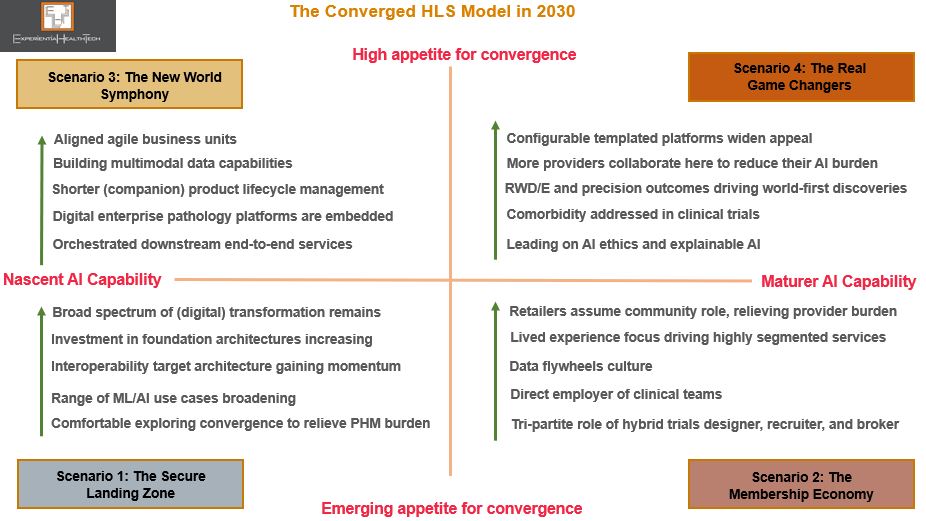

By example, the four future scenarios to 2030 outlined below are framed within two axes: appetite for convergence and AI maturity level – which I see as wholly aligned. Underpinning these are 64 variables.

As we move towards greater convergence, no single HLS sector dominates. Here, the HLS actors evolve beyond their core position, to assume different roles within new configurations:

- Acting as a leader in one scenario

- Acting as a new partner in another scenario

In fact, within three of these scenarios, there are HLS companies that are outperforming the incumbents.

A growing shift in mindset is resulting in more incumbent leader viewing convergence as a way to remove the burden of innovation from their shoulders, and a strategic accelerant to Transformation.

Here’s some further detail on each scenario.

The Secure Landing Zone

The Membership Economy

The New World Symphony

The Real Game Changers

Scenarios will help your teams not only to assess the strength of your position within each future state, but also to validate, flag up, and steer what you do next in response.

I hope this proves useful. In future posts, I’ll highlight strong exemplars.

If you have any questions or would like to explore further, feel free to reach put to me.

Discord Within the Ohana Tribe | What’s Next for Salesforce?

When a pioneer and elusive competitor like Salesforce falls from its pedestal, it lands hard. And its leadership is judged all the more harshly.

Perhaps it was always naïve to assume that the co-CEO model, and post-acquisition mergers would be any smoother here. But Marc Benioff has built momentum around ‘Ohana’. This past month has diluted the strength of this culture when pitted against profit.

Although the headlines have been slanted towards the enterprise perspective, its HLS businesses will not be immune, given the strategic direction in which they’re being pulled. Salesforce has been gearing to move deeper into the HLS stack, yet clearly views a single integrated proposition (enterprise bleeding into vertical portfolios) as logical from a cost and profits perspective.

Note that Salesforce has read the markets clearly, and in polar opposite style to the recent move from Oracle, has been delivering a mature response, recognising the buyer preference for hybrid choices to extend capability. HLS can also gain from some of the recent enterprise-side additions:

- ‘Bring your own AI’, a combo of Amazon’s ML SageMaker and Salesforce’s AI solution Einstein

- The ‘Amazon S3 Connector for Tableau’

- Blended FHIR and HL7v2 protocols

Aligning Buyer-Seller Ambition

But the HLS buyer lens is narrower. Up until now, each core portfolio offer from the Salesforce stable has been clear cut in its support of meeting their key transformational milestones: Tableau (HIPPA compliant Cloud; Data Visualisation & analytics); Mulesoft (interoperability; EPR integration layers); Slack (collaboration); and Salesforce Marketing Cloud (Patient Experience & Engagement). In tandem, Salesforce has been positioning on Product-Led Growth.

The risk with this shift – which is more than cross-selling – is that HLS perceives such an integrated extensive proposition as overwhelming, or inaccessible to current need and pace.

Case Study | The NHS and Public Sector in England

Salesforce is in the midst of a second attempt to anchor itself across the NHS. Its first attempt was in 2013 in England. However, given the transformational overhaul underway at central and frontline levels back then, it proved challenging for many buyers to clarify their tech needs.

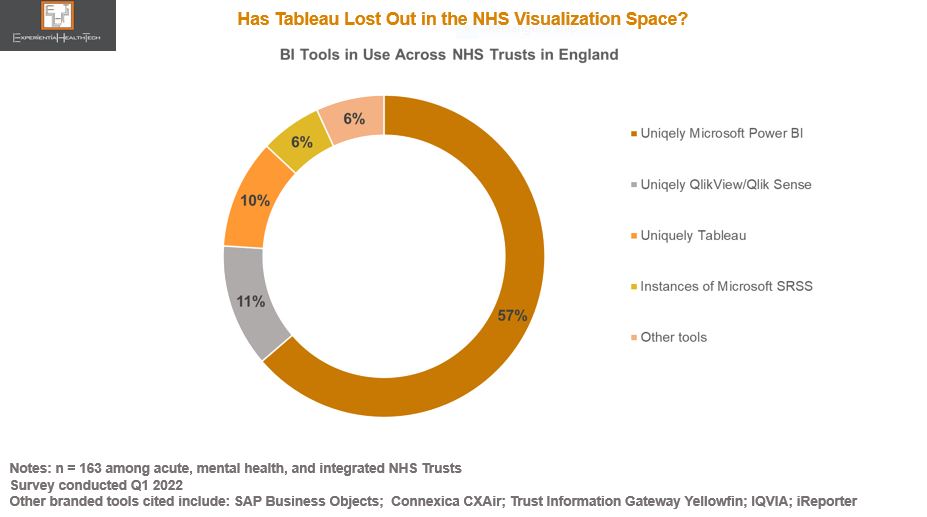

Tableau is an important part of the Salesforce portfolio mix. With data, analytics, and data literacy identified as high priorities for all clinical and non-clinical roles, Tableau is accessible, and therefore facilitates building a business case. But its Account Managers will face a hard graft.

Currently, the Tableau footprint is small at individual provider level, despite the central procurement on their behalf by NHS Digital in 2021: other legacy choices continue, while an ‘Enterprise’ deal struck with Microsoft to include free Business Intelligence instances is proving an obstacle to greater Tableau uptake. Microsoft Teams also penetrated the NHS heavily as a collaborative tool through the pandemic.

In recognition of the challenge, Salesforce is positioning with data driven use cases: workforce management, outpatient flow, screening, patient outreach, advanced therapy management, and drill-down population health.

More encouragingly, Tableau has built a solid relationship with the Open Data and Data Visualisation team within NHS Digital during the COVID-19 pandemic. Although Tableau takes most of the credit for the outcomes achieved – including the donation of the sizeable software implementation – it was once again comfortable working alongside AWS.

The reference above to drill-down population health use cases stems from this relationship. Such was the success, that at one point, 75% of Local Authorities in England were also using the Tableau dashboard on a daily basis, to co-ordinate vaccine outreach at neighbourhood level. A closer strategic partnership between Tableau and NHS Digital appears likely. Migration to the Cloud has been cited as one element on the ‘to do’ list.

In addition, its recent Memorandum of Understanding (MoU) signed with the Crown Commercial Service across the Public Sector may raise the Salesforce profile through buyers’ exploration of low-code no-code capability, alongside access to free experimental project support, and discounted training, among other benefits.

These MoUs are increasingly common across the UK Public Sector, providing one way for vendors to gain more rapid wider-scale accreditation through a commitment to favourable pricing arrangements and access to innovation. It’s not the only procurement channel open to technology buyers – in the UK they can choose from a vast array of frameworks – but it’s good for brand credentials and relationship building.

The Experience Layer Develops

Given the likelihood that Salesforce Executives knew about the planned New Year layoffs. investment in HLS has continued.

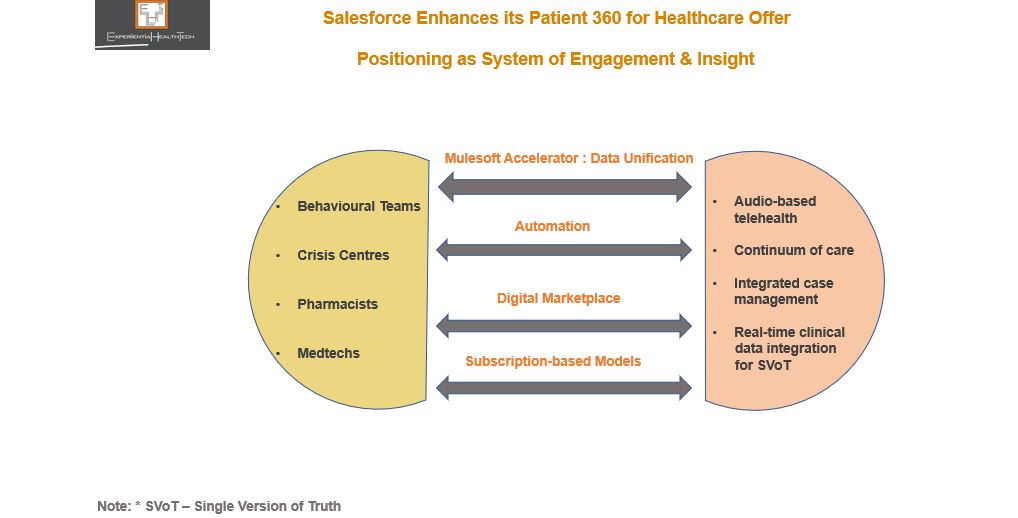

The extent of Salesforce’s HLS ambition was evidenced in November, with the range of enhancements to its ‘Patient 360’ platform, introducing support for behavioural health teams and pharmacists, a nod to the multidisciplinary service model many healthcare systems are striving to develop.

Support for crisis centres shouldn’t go unnoticed either. Although a budget may not be directly available at this level, their inclusion will likely be steered from the sizeable provider or payer installed base already supported by Salesforce.

Charting New Routes to Profit-Led Growth

What’s particularly exciting is the newly minted retail strategic announcement between Salesforce and Walmart, potentially carving a new route to exploit ahead of some of its rivals.

Leadership at Walmart has multiple times over proved itself as visionary. The suggestions above in relation to a Healthcare setting may never materialise in this form, but given the ambition of both parties in the US, and the struggles of many of the leading ‘disruptors’ over the last year, this level headed coupling could break new ground.

Walmart’s Commercial Technology unit reflects the confidence to take its in-house developed solutions to the wider market. It’s worth noting too that it already excels at data-driven insight, honed through its loyal consumer-side installed base. With clinical trials the next frontier within retail health, Salesforce could prove a worthy ally for Walmart to accelerate effort here, given its solid footing within Life Sciences.

Salesforce’s Commitment to ‘The Experience’ Will Be Tested

FY2023/2024 is pivotal.

Given its HLS footprint, the pieces are in place to exploit a range of intersectional investment contexts, since provider, payers, medtechs, and Life Science players are each seeking models towards sustainable value based care. Each of these sectors will encounter Salesforce in different contexts.

But Salesforce has also suffered a slew of voluntary departures among key execs from across the business, which may concern prospective buyers and its installed base alike. With ‘trailblazing’ currently not a priority across HLS, neither price hikes nor reduced support will be palatable, as many vendors are already discovering.

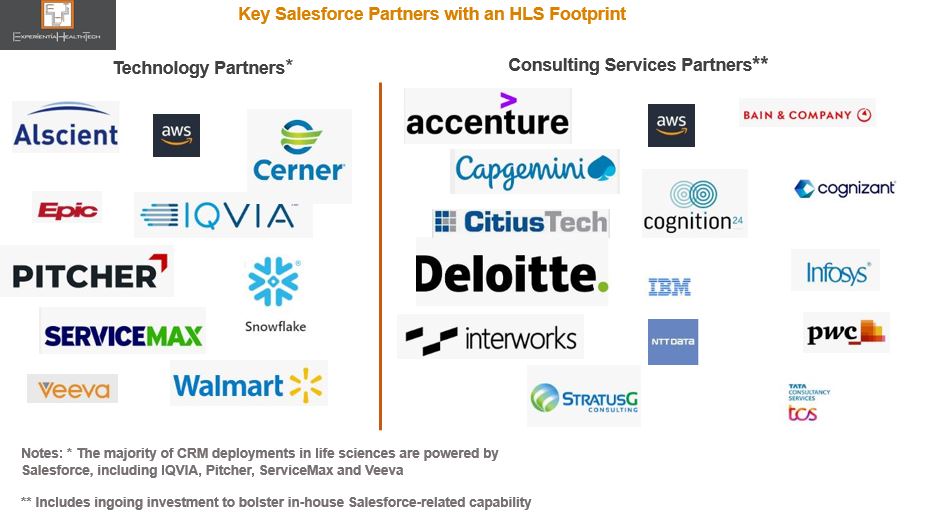

Partners will therefore be key to translate Salesforce aspirations and uphold its commitment – but several are also riding out their own storms.

Palantir and the NHS | So Near and Yet So Far

Palantir positions itself as a data harmonizer, integrator, and analytics facilitator, yet its National Health Service (NHS) detractors label it a data thief. The current barrage of recycled criticism surrounding the company is short sighted, when really, Palantir is being scapegoated for a decade of poor NHS leadership on nurturing a data driven culture.

Now, the NHS Transformation Directorate (a merger between the former NHS Digital, NHSX, and NHS England) is spending inordinate amounts of time defending its decision to exploit the effective partnership it forged with Palantir through the pandemic.

One upcoming ‘open’ contract, yet to be run, must rank among the most controversial in the history of NHS technology procurement:

- A five-year relationship (with an option to extend by a further 2 years) worth £360m, to co-create a national data analytics platform, aka Federated Data Platform (FDP). This will enable analysis of disparate data streams from across the 42 newly established local Integrated Care Systems (ICSs).

Three key issues underpin the hotly debated and at times mis-interpreted discourse:

- Outward behaviour has had the rumour mill running at an all time high that Palantir and NHS leaders have already jointly decided the structure and running of the FDP, so that the open tender is no more than a rubber-stamping exercise, to camouflage the award of the biggest chunk to Palantir. This also includes the recruitment of two former NHS England executives who had been working closely with Palantir through the pandemic;

- No NHS-wide debate has been held to champion this next chapter, or reassure frontline teams on data sharing and privacy-by-design. Contrary to general perception, we’re told that the FDP is not intended to directly support patients’ care. It will reportedly initially be used for the national management of vaccines and immunisation programmes, population health, elective waiting lists, and meds & equipment supply chains;

- Yet, relationships are further strained when we’re to believe that shared care records, which the vast majority of ICSs now have created in some form, will feed into the FDP. Not everything adds up, and key stakeholders rightly expect transparency;

- Yet, relationships are further strained when we’re to believe that shared care records, which the vast majority of ICSs now have created in some form, will feed into the FDP. Not everything adds up, and key stakeholders rightly expect transparency;

- The company’s heritage in classified security and military-related contracts.

So much so that the release of the tender has been delayed twice so far.

Blinkered NHS Leadership

Perhaps part of the problem here lies in the drive by NHS leaders to accelerate at scale and pace. They have a legacy of spectacular failure in public, patient-advocacy, GP, and provider engagement over data sharing, ownership, and privacy.

That US providers continue to renew Palantir contracts seems to offer no reassurance on issues such as trust and data privacy. If anything, this further stokes the debate on the higher likelihood of the English model ‘descending’ towards privatised healthcare – in a culture steeped in free at the point of care, any mention of patients paying for at least some of their healthcare sparks outright fury. And yet the reality is that the self-payment model has been gaining traction among those unwilling to sit out delays of several years before being offered intervention.

There is a huge spectrum of digitally enabled transformation across the NHS. The successful stories emanate from strong local leadership teams. This in itself represents another oddity within NHS policy here : When it suits, frontline leaders are offered match funding for tech innovation and advised that ‘local knows best”; in other instances, such as with this FDP, a top down model is all but imposed.

Drowning in Data Yet Low Population Health Insight

We know that the ICSs and their aligned Boards have multiple challenges ahead to ensure on par digital maturity, while still grappling with paper-based settings and EPR deficits (a mandate has recently been set to close this deficit).

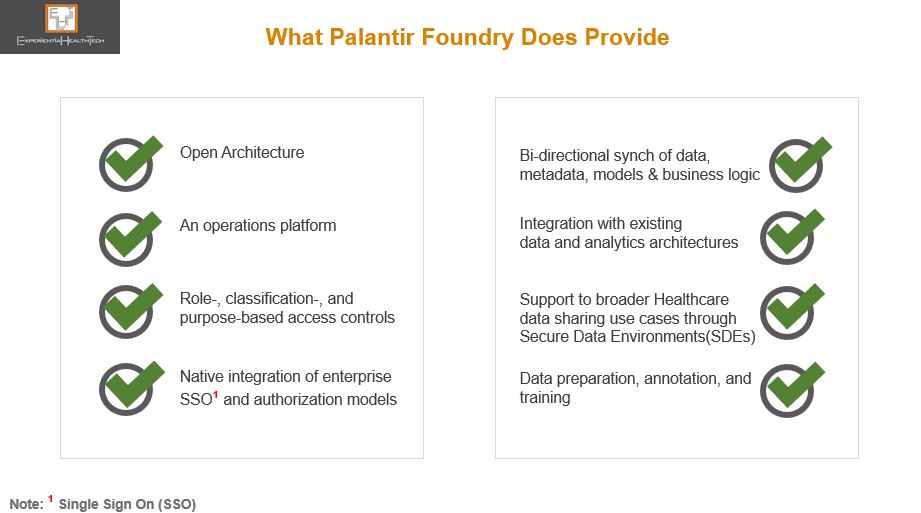

The NHS needs and wants much of what Palantir has to offer: a federated setting with strong governance foundations, interoperability, model-agnostic methods, open architecture, operational & decision intelligence, AI-on-the-fly, AI for IoT and Edge, “co-create once and repurpose”, and vertical platforms.

Most recently, through The London Medical Imaging & AI Centre for Value Based Healthcare, NHS leaders had a golden opportunity to create a wider coalition of the willing among frontline teams, to embrace a federated learning model. That hasn’t happened, with the result that this apparent leapfrog into a longer term and more consequential relationship is drawing such criticism and alarm.

But there is a clear line between both these projects: in the Value Based Care initiative, although tech companies were clearly involved, NHS Digital was in the driving seat. In this FDP initiative, the feeling is that these same leaders are handing over the crown jewels of NHS rich data to Palantir.

The justification for the tender is that the skills needed to build and manage such a platform go way beyond the collective capability of the NHS frontline, at a time of its greatest operational challenge.

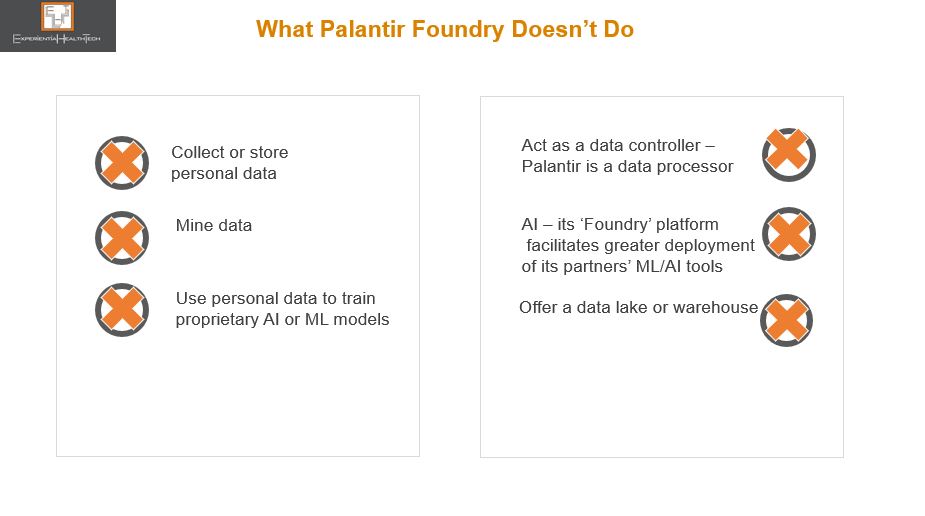

While there are clinical and IT leaders who support this move, the drive to embed this nationally is still facing strong resistance. Not to over-simplify the tensions here, it’s worth busting some myths over Palantir:

Palantir Takes Up Mentoring

Palantir has clearly worked its successful pandemic relationship with the NHS to good effect. That approach too has been criticised. But let’s face it, this is no different a tactic from other vendors over the years, including many of those that stood up solutions for free through COVID-19. Equally, many vendors have over the years sought my advice on which among the NHS England/NHS Digital/ NHSX leaders they should woo, to embed their respective tech philosophy.

Palantir has also stepped in to reassure on what to expect, should it win the largest part of the FDP work. But much of the language used is elusive to many frontline teams.

The NHS Transformation Directorate may plough on and coronate Palantir, offering the 3 other related FDP tender parts to other bidders – note that the names in the running are not mainstream to the NHS. One of these vendors has confirmed its intention to submit a bid as part of a consortium.

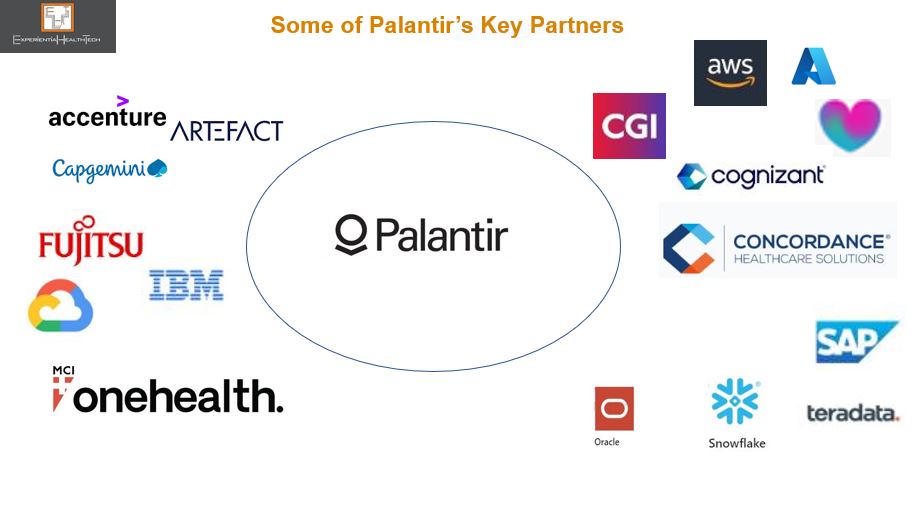

This is a further irony given the range of high calibre partners signing up to work with Palantir in general, many of which independently have forged solid trusted relationships with the NHS, and which within the context of this FDP contract will have to engage with Palantir on some level.

Or, as is currently politically fashionable, we may yet see a U-turn (expensive).

There is perhaps never an optimal time to go ‘big and bold’, but this is what’s being prioritised. This is high stakes for both the NHS and Palantir.

Expect the debate to rage on, post-contract award. This expenditure carries all round high expectation on deliverables and frontline outcomes over the timelines carved out.

Multimodal Learning and Composite AI | Accelerants to HLS Precision

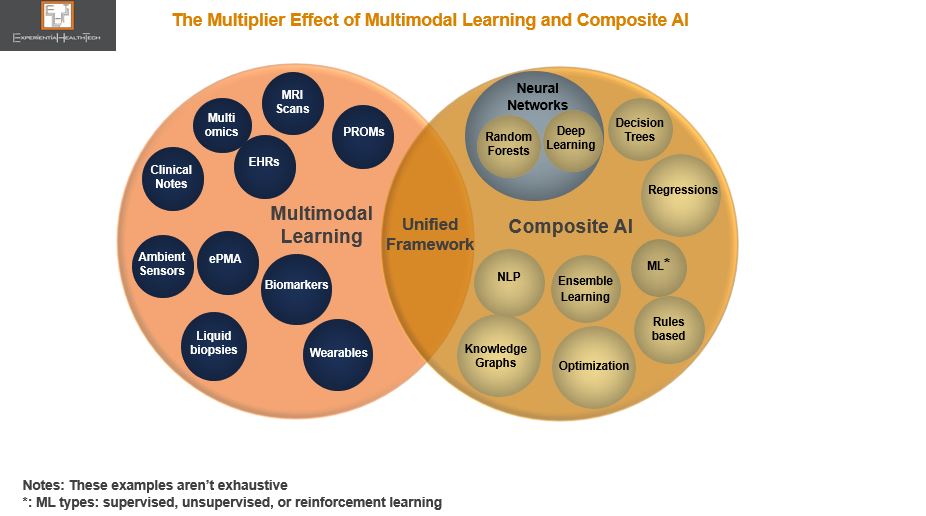

It may be counterintuitive to position AI as an accelerant to precision. And yet an under-exploited paradigm, Multimodal Learning combined with Composite AI, is powering discovery, resetting the benchmark for ‘real world’, and evidencing that precision medicine isn’t a pipe dream. If a broader range of stakeholders across Healthcare & Life Sciences are to benefit, our mainstream conversation needs to evolve. More SITS vendors must step up in support.

We know that a lot of work under the ‘AI’ banner has as many moving parts and shortfalls as it has roadblocks. We also know that embedded within the volumes of good data collected across HLS are swathes of rich but untapped information.

We have reached a tipping point: our current practice of training algorithms from a single modality (e.g. imaging, text, or stats) to validate a tightly defined query doesn’t do justice to our universal efforts to understand comorbidity, monitor disease recurrence, or advance personalised care, and drugs discovery.

There is an alternative aligned approach, with successful field deployment:

- 𝐌𝐮𝐥𝐭𝐢𝐦𝐨𝐝𝐚𝐥 𝐋𝐞𝐚𝐫𝐧𝐢𝐧𝐠: Disconnected, heterogeneous (raw) data is harmonised, mined, and then unified into a single model;

- The backbone powering this is 𝐂𝐨𝐦𝐩𝐨𝐬𝐢𝐭𝐞 𝐀𝐈, which exploits a range of ML and non-ML techniques, in the context of the specific problem to be solved. This range works together sequentially to ‘fuse’ this data, by disassembling and normalising within one specific technique, before sending it on to another technique to apply further meaning – ‘passing the baton’, in a relay race, if you like. This multi-dimensional approach to tackling real-world problems delivers more granularity and scalability, which has eluded HLS.

Once synthesized, the insight is unified within a framework, which can be shared – several are available through open-source.

Blending The Known Unknowns with the Unknown Unknowns

The sheer range of data that can be exploited may seem over-whelming. However, multimodal isn’t a new approach, with pioneers across HLS already comfortably sharing their respective data with partners to advance.

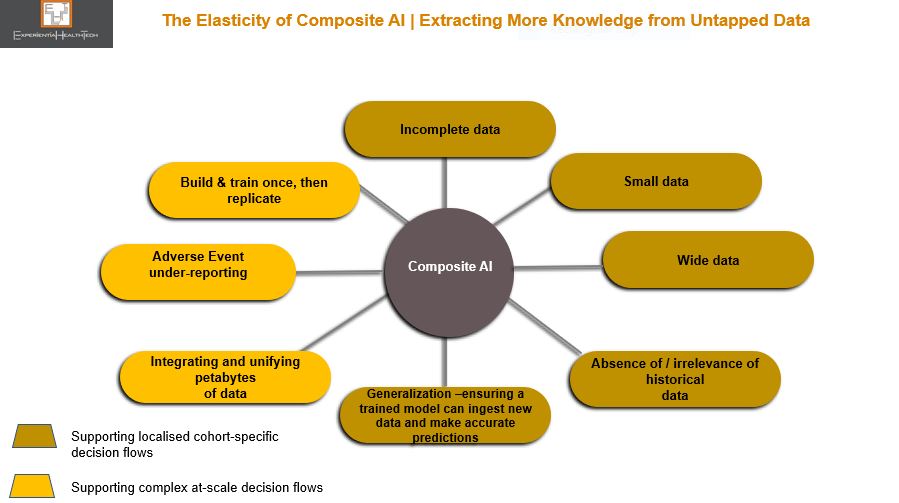

Equally, composite AI may seem daunting, but that need not be the case. The beauty of composite is its elasticity, in that only a few techniques need be applied for greater effect, in alignment to the range of data held, knowledge gaps that need to be filled, and respective skills base.

Acknowledged gains of Composite AI include:

- More granular information than RWE

- Deeper understanding at a molecular level

- Outperforms single modal AI

- Embeds Federal Learning and privacy-by-design

- Preservation of human knowledge within the loop ‘rounds out’ the data interpretation more deeply, thereby strengthening the analytical process

- Users/collaborations add ML/AI techniques at their own pace and capability

Explainability Versus Interpretability

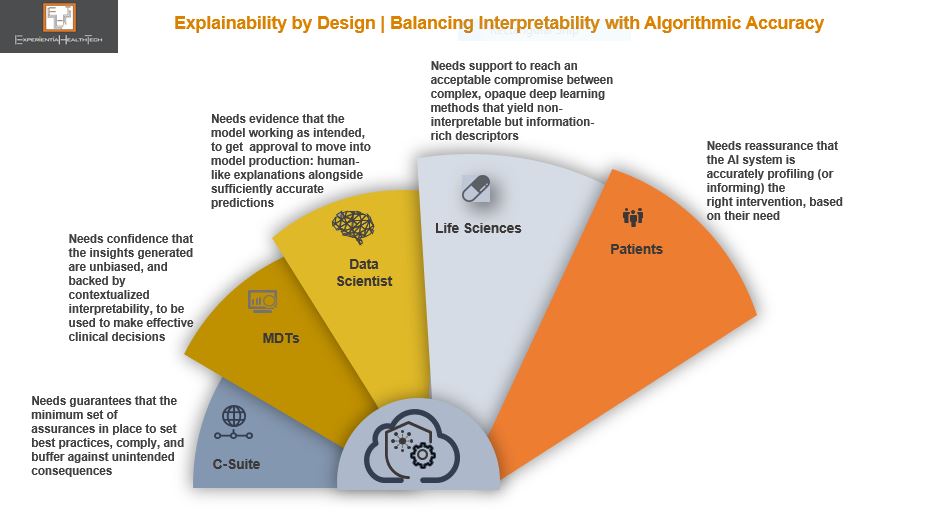

We may all be familiar with the concept of Explainable AI (XAI), but it’s a generic reference that a whole range of stakeholders, each with differing priorities, are supposed to get their heads around.

This is where the notion of a trade-off in a pragmatic sense needs to be introduced to the mainstream conversation. As we apply some non-ML approaches techniques, which make up the other part of the Composite AI toolkit, in our quest for better detail, the black box comes fully into our front mirror. And we know the level of discomfort this provokes within the HLS community.

While some stakeholders may be comfortable with ML and automation, since these have been widely debated and evidenced, most will not be familiar of the inner workings of a composite model. While these HLS roles don’t need to be experts, there is a strong argument now for at least familiarising them with the basic principles, in relation to those techniques which lend themselves to high explainability, versus those that don’t.

For example, decision trees, which embed graphical representation, can convert data into a narrative of what’s going on. In contrast, Deep Learning, where the model trains itself to process and learn from data, yields low explainability, since the neural networks within are very difficult to interpret.

The trade-off here is whether to accept higher accuracy over single modal AI models, in exchange for less transparency behind the findings in complex data scenarios. We are after all still struggling to strike a balance between the flow of innovation, data fatigue, and actionable insights. This debate will continue for the foreseeable future.

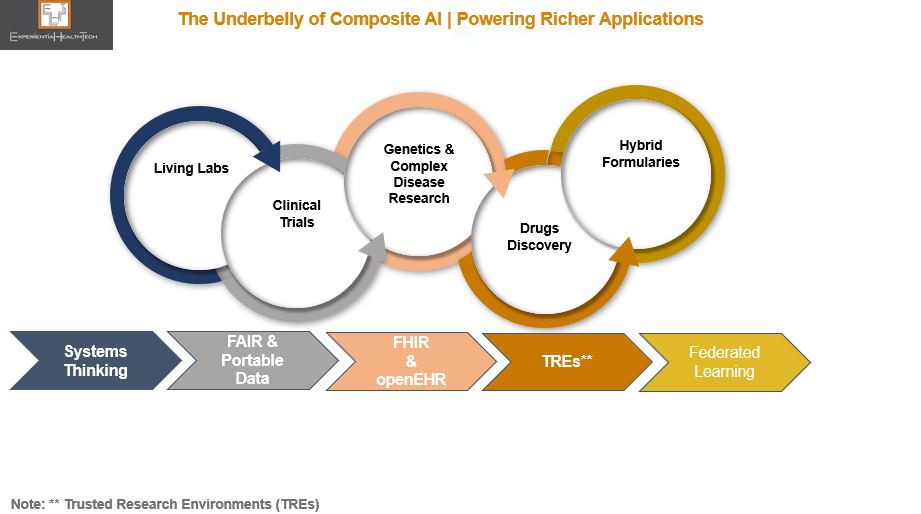

With Multimodal Learning, No-One Acts Alone | Biotech Orchestrates; Pharma & Providers Collaborate

To relieve the burden of ML/AI maturity, this approach validates the need for Orchestrators from across HLS. The growing momentum behind Trusted Research Environments (TREs), systems thinking, and openEHR, across organisations and between research partners, is testament to this. These practices also help to position both Multimodal Learning and Composite AI in a constructive pragmatic light, as multi-disciplinary practices that advance great work among mutually respected peers.

SITS vendors have a role to play here too, alongside HLS teams, to champion the collection of good data, while working to ethics, non-bias, and responsibility. These are challenging but necessary codes of data management conduct that we must instil.

Current composite capability across HLS is already generating richer insight to supply novel intervention. Above are some of the key areas which stand to gain a lot, from healthcare systems such as the HSE in Ireland and NHS in Scotland currently rolling out Living Labs, through to the ongoing collaborative work across clinical trials and drugs discovery. With regulation in more European countries starting to acknowledge and reimburse digital therapeutics, this will, over time, pave the way to capture even more real world data at the edge.

One example is oncology, where multiple projects are exploiting multimodal data in one clinical area, and applying it to another, to better understand the correlation between some comorbidities – powerful stuff. Among these are the many Pharmaceutical leaders shifting their teams’ focus to targeted therapeutics designed for smaller patient cohorts.

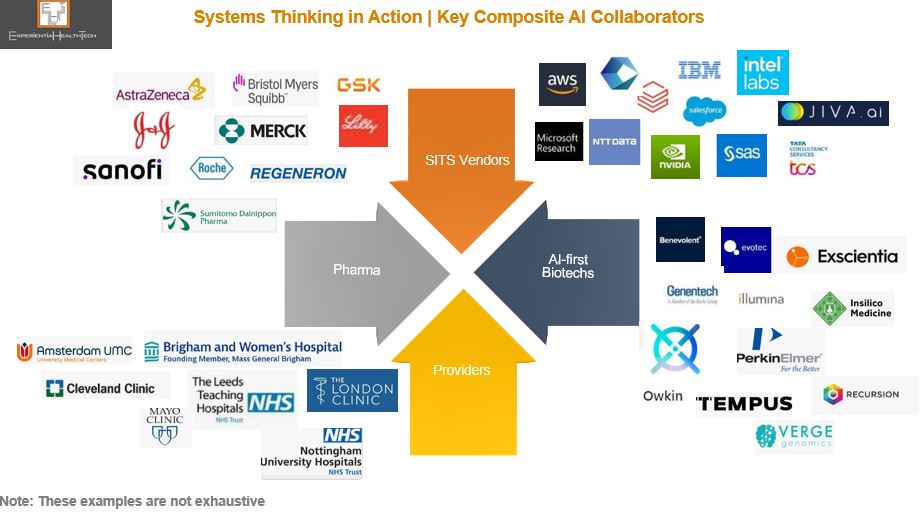

Although in many, but not all instances, AI-first biotechs are the Orchestrators, they’re financially supported by a growing number of Pharma partners, via outcomes-based collaborations.

I’ve highlighted the biotech community in other posts as a cultural breath of fresh air. Yes, some parts of the sector are having a rough time at the minute, but there is some brilliant work coming through from pioneers, some of which feature above. The fact that they refuse to form exclusive relationships, yet are highly sensitive to IP preservation has been encouraging more from within the Pharma community to strike partnerships underpinned by Multimodal Learning and Composite AI.

From big tech, SaaS and vertical cloud players have been among the more recent additions to the Composite AI field, and all the signs, including investment, indicate they’re taking this seriously. More providers are joining. And this can only be good.

Composite AI isn’t a silver bullet. More SITS vendors can help to curate, steer, and widen their services offer. Skills support is also a solid way to build customer loyalty.

The Bottom line

We need a move away from the lean diet of ‘ML is doable in single mode; AI is elusive’.

We also need to put our burgeoning information pipelines to much netter use. Composite AI offers an effective path through which to advance at a pace and scale superior to most effort under way today. And while Composite AI isn’t for everyone, it can support multiple current and emerging use cases.

Further, as the concept of Ecosystem 2.0 evolves, Multimodal Learning and Composite AI will attract high calibre members, excited by the potential of what can be achieved together, with confidence.

Retail Pharmacy’s Transformation and the Foothills of AI

Once outliers, incumbent US retail pharmacy chains have spent the last 6 years manoeuvring into position as the lynchpin for the Quadruple Aim.

Given the complex make-up of the US Healthcare system, this has been no mean achievement, and should be applauded. Yes, the market is large enough to keep attracting new players looking to disrupt primary care, such as Babylon Health. But Retail Pharmacy already enjoys a solid footprint across all US States, with a rich heritage of customer loyalty.

Its leaders have evolved to the point where advancing deeper into the Healthcare stack with a well-rounded primary care offer makes so much sense.

Transformation and the Order of Competitive Play

We talk about Transformation, Digital Transformation, and Disruption as if organizations are hard wired to know when and how to ‘do’ this.

The Retail Pharma sector is transforming and disrupting, with success stories to share. Its leaders have always understood that:

- They as incumbents must disrupt beyond their installed base of customers. They haven’t deviated from their core mission – to support under-served communities – yet their strategic announcements through 2022 align to the fact that so many more US citizens fall into this category of ‘unsupported at different stages of their wellness and health;

- Disruption generates growth – ‘going digital’ doesn’t;

- To disrupt, you first have to define your future today, despite market uncertainties and flux, and prepare every area of your business to pursue this. This may seem counter-intuitive, but by using insight to keep track of headwinds and tailwinds, vision and strategy are better informed, and take out guess work or reliance on intuition.

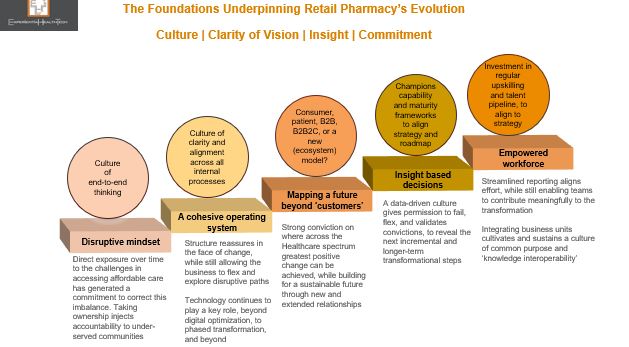

Culture| Clarity of Vision | Insight| Commitment

There are very clear characteristics that set successful companies apart, in any sector. Above all else, the old adage about culture still rings true. Culture is their compass, barometer, and altimeter all in one. Once an organisation agrees its vision and the scale of transformation needed to deliver, culture keeps leaders and the workforce aligned.

Successive Retail Pharmacy leaders within each of the leading 3 US players – CVS, Walgreens, and Walmart – honour these principles.

They are champions of end-to-end thinking: Setting a vision that extends beyond 10 years; being comfortable with not having all the answers up front, yet identifying the customer of the future they want to support, through new service models. Ironically, this mindset is interdependent on openness and evolution, where collaborative solution-building becomes the norm.

Transformation is by nature complex and can never be considered complete. Organisations need a balance of yin and yang to ensure structure and pace. That translates as driving through an internal operational overhaul, to ensure watertight efficiency. This in turn facilitates a meaningful value proposition for the market. In the case of Retail Pharmacy, all roads need to lead to value based care, underpinned by outcomes.

But there are cautionary notes:

- Given the installed bases at stake, at-pace scaling mustn’t compromise patient safety. Some investigative reports in the US (outside my remit) claim intense KPI metrics have led to multiple cases of prescribing admin errors. As Europe (currently a digital laggard) gears up for ePrescribing, this aspect will be scrutinised. Trust is precious;

- Both Walgreens and Optum Group (now a partner of Walmart) claim to be payor agnostic and champion equity, but have yet to truly reset the status quo on transparency and out-of-pocket expenses. Meanwhile, note the growing momentum behind the much smaller @RosettaHealth and its evidenced framework, delivering eye-watering savings for members.

Insight is Our Oxygen Through Transformation

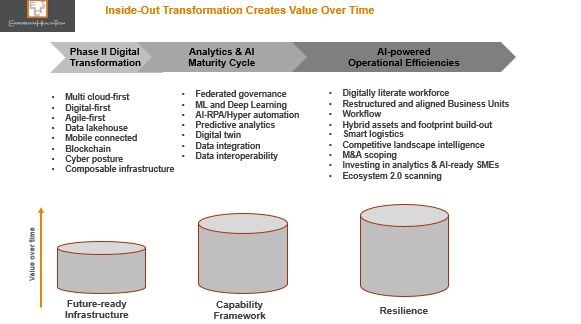

Insight, based on good data, validates effort when we see small and ongoing positive outcomes. It keeps an organisation’s workforce and partners close to its mission. Analytics and AI-driven insight is intertwined with Transformation.

Experiential HealthTech defines AI in today’s market context as Augmented Intelligence. This not only reflects the capability maturity across Healthcare – embryonic – but also re-enforces that AI will remain a blend of machine and human interaction. This is vital across Healthcare, which needs to keep high touch contexts- as far as resourcing permits.

The analytics and AI maturity cycles at operational and market-facing levels are broad, and the pace and scale at which Retail Pharmacy organisations are working through these are dictated by their internal reconfigurations and partnerships.

Throughout the COVID pandemic, one thing became clear: there were petabytes of untapped rich data across Retail Pharmacy. And like other organisations already on a transformation path, radical effective responses could be accelerated, with confidence.

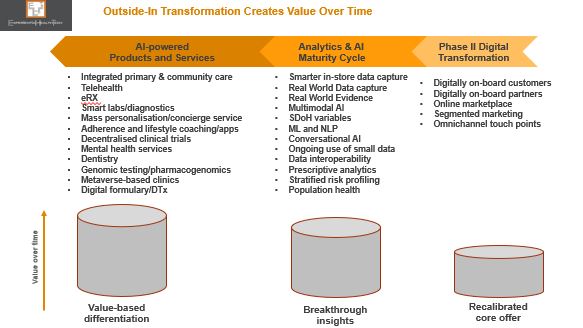

This success will likely have altered Retail Pharmacy incumbents’ next phase priorities: while a degree of competitive overlap remains across their roadmaps, there are also liberal doses of ‘dare to imagine’, with ambition flagged against decentralised clinical trials and pharmacogenomics.

Technology and Digital Blend

Tech partnerships have proved and remain invaluable to Retail Pharmacy. The collaborations being signed, to ensure ongoing enterprise and analytics/AI maturity, showcase how some ‘big’ players are comfortable carving a future-state based on value-driven partnerships and knowledge sharing, rather than ‘fixing’ Healthcare with a land grab. Nor are these retailers insisting on exclusivity – Microsoft, for example is supporting more than one with their ongoing transformation.

These are just some of the few currently supporting the sector.

Healthtech SMEs and AI

SMEs in the form of biotechs, virtual care , and digital therapeutics specialists are contributing significantly across Healthcare. Some embed analytics and other AI modes as a competitive differentiator from Day 1. Many haven’t even started along this road. And yet they must, because we need to end up with SMEs that are part of a wider contribution to society, supporting real world need, workflow and other processes. Point solutions help no-one.

For that reason, the interlinking internal and market facing transformation phases outlined above are just as relevant for them.

Retail Pharmacy leaders’ vision does include greater collaborative SME ventures, but for the moment risk is largely managed and weighted within VC funding, or support to modernise the SME operation as a future-proof.

As their market facing services portfolio continues to evolve and augment the Healthcare-at-Home vision, I expect to see a wide range of SME-related announcements:

- CVS, for example, continues to back analytics and virtual care specialist Biofourmis (Series D) – and so a multimodal AI focus may yet emerge to align with CVS’ direction.

- In India, Walmart is training 5,000 micro and SMEs (micro enterprises are the backbone of the Indian economy) over a 5-year period. Participants will have access to advanced business tools and advisory support to grow their offline and online businesses. There is an additional potential to advance and gain accreditation through the Walmart marketplace.

This isn’t about conquering: it is about broadening the spectrum of affordable choice, equity, and bridging more of the chasms across the Healthcare system, to enhance local population health. Good data and the power of outreach will remain critical levers. (smaller) Peers elsewhere can copy aspects of this model to start out on their own Transformation.

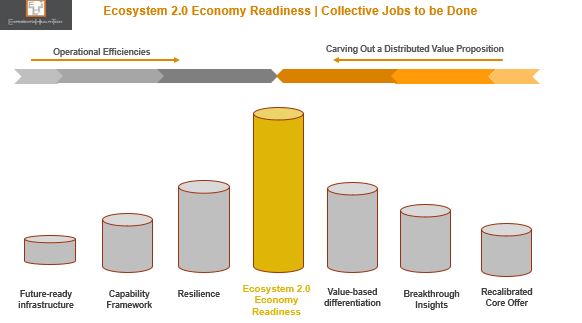

The Ecosystem 2.0 Economy Beckons

I believe the greatest breakthrough in the US initially will come from a willingness to forge a new model – based on Ecosystem 2.0 – which as composite organisations these 3 US players could orchestrate or contribute to, when the time is right.

In the meantime, the new relationships being forged with payors and their provider networks, Pharma, and SMEs bode well.

From Happify to Twill | A Masterclass in Patient-Centricity

Attempts to be ‘patient centric’ still elude many practitioners across Healthcare.

Ironically, it’s the new breed of health tech bellwethers that have grasped patient-centricity (PX) from the outset, and kept it core to every aspect of their mission.

One such exemplar is Happify Health, one of 6 companies I highlighted in my 2022 Trends report “The Year of Purpose-Led Convergence | Vendor Watch List”. From a range of backgrounds, these have been selected for their marked capability to lead and converge with purpose, beyond their core. They have not only recognised the cracks in the current system, but are moving to bridge these through novel approaches. Also recognising that rigid adherence to the status quo impacts on bottom line, relevance, and relationships, they are comfortable working across frontiers.

Here’s what I wrote:

“Happify Health: An evidence based DTx (digital therapeutics) specialist, which has gone from strength to strength within the mental health sector. Heavy investment over the years has enabled it to truly understand buying personas and channels, and to design a portfolio to meet these respective needs. Its platform now supports +50 medical devices and multiple apps.

But here’s the thing: not content with designing a broad portfolio to accommodate varied demand cases, it is now prepping to support acute chronic care instances which trigger mental health problems. There is a significant chasm to cross here, and what it’s proposing excites me.

Happify is also fluent in ‘Ecosystem 2.0’ thinking.” – as defined by Experiential HealthTech.

And so, I’m not surprised about the next chapter, marked by its transition to @Twill.

Simply Experiential™ | Twill in Motion

The birth of Twill consolidates its progress over the last 5 years – expanding from D2C to B2B, and the launch of its prescription DTx range – while signalling its ambitious next 5-year plan: to map deeper into an individual’s treatment cycle to offer as bespoke a range of interventions as possible.

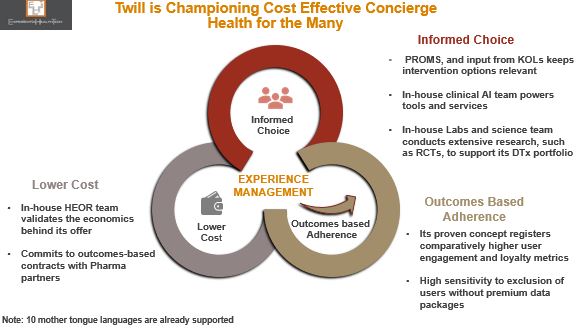

Why is this important? Happify has, with scientific evidence, successfully brought together more service components than many of its peers. PX is its DNA: near real-time PROMS data moves with the patient to inform decisions – it has successfully proved that much of the time (but not all), it is possible to circumnavigate the EHR and still exploit new rich data. Individual service users gain directly through deeper engagement and informed choice.

Equally importantly, Twill’s leadership is demonstrating the balanced equation of outcomes-based adherence and lower cost to health systems, Pharma, and payers alike – KPIs with which all Healthcare stakeholders continue to grapple.

There are four new inter-related components which will uphold its future direction.

The launch of Sequences™ | One Step Closer to Personalised Care

The trust placed in Twill by the Healthcare, Life Sciences, and payor communities has resulted in Sequences™, its “end-to-end digital framework”. This translates as a range of modular service options, to reflect the many support contexts typically out of scope among these Healthcare stakeholders, since they’re not operationally geared to configure at this level: evidence-based DTx, well-being products, peer communities, a multi-disciplinary clinical team, and coaching; quick reference, initial diagnosis, short-term and/or longer-term support.

An additional attraction to the partners that have signed up to this is the strong collaborative and co-design foundations on which Sequences is built – providing them with a gateway to new receptive patients and citizens, which have already independently formed trusted relationships with Twill.

But Twill’s biggest differentiator is that it’s one of the few working at the intersection of mental health and acute comorbidity. This is so important, and it’s more than frustrating that more organisations aren’t acknowledging this as ‘the problem we need to solve, together”.

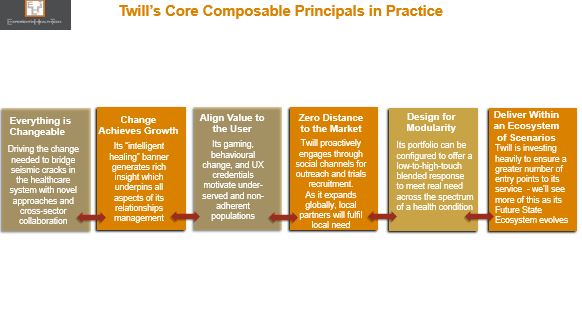

A Look At Twill’s Guiding Composable Principles

Delivery of this model isn’t easy. In my view, Twill has incrementally moved into this position of strength by operating as a composable organisation in all but name. These principals truly embody patient centricity and move way beyond lip service to PX, to deliver a radically improved experience for those living with a chronic condition which is also impacting their mental health.

There are 6 overarching components of composability, which define an organisation’s relationship with its clients and partners, and which form the foundations of the incremental steps they take towards Ecosystem 2.0.

The leadership culture driving composability is the realisation that we achieve more together. Twill is clear that it will not strive to design every solution inhouse, but will happily bring in third party expertise, either directly, or to accommodate third parties already deployed within its B2B client base.

But this will be no loose amalgamation of products. Twill’s portfolio is already of a high enough calibre today to attract complementary third parties, recognising not only the valuable network effect of its open (API-driven) platform, but also the potential of a more rewarding future: migrating away from point solutions to offer a model that not only resonates with service demand gaps, but also chimes with the new forms of clinical workflow and patient flow that we’re crying out for.

That is why Experiential HealthTech classes Twill as an Ecosystem 2.0 orchestrator.

Ecosystem 2.0 with Twill in Outline

The model outlined below reflects where Twill is today (Layers 1 &2), and how potentially it could start to orchestrate its ecosystem (Layer 3). What’s exciting is that new ecosystem members will also steer, contribute to, and govern this future cross-sector state.

Localised members will also respond to local need, and help to accelerate the rate at which Twill can scale, globally, as is clearly its intention.

Federations of secure data exchange

With the permission of its service users, Twill has already built up an enviable rich data set. As its ecosystem grows, the potential to incrementally enhance its clinical AI base is immense – evidence garnered from clinical trials alone, to steer prescription therapeutics, is exciting.

But this is a two-way street. All ecosystem members must commit to Twill’s federated data underpin. Outcomes data from referrals to third parties must be shared back with Twill – to monitor response rates to this intervention, but also to enable Twill to suggest alternative treatment if low outcomes are registered. All of this data creates a SVoT (single record) per service user, and bolsters Twill’s longitudinal system of insight. Population cohort support is also planned.

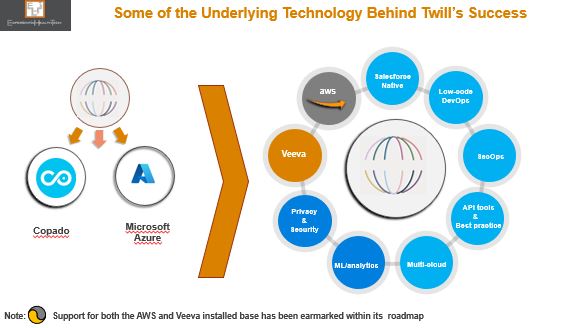

Below is a snapshot of some of the technology investment Twill has committed to. And of course this carries the potential to augment its reach. You can see how this lends itself to Ecosystem 2.0.

This is the future. Not for all of us. But for very many. Experiential HealthTech looks forward to seeing what emerges next from Twill.

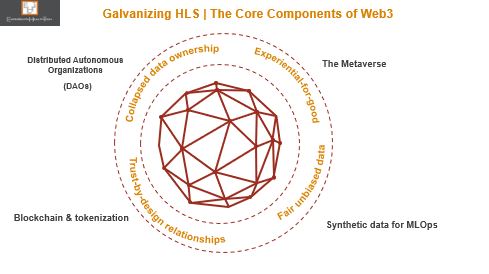

Could Web3 Galvanize Healthcare and Life Sciences?

Healthcare and Life Sciences (HLS) leaders have dug a lot of deep holes for themselves. Could Web3 yet prove their saviour, and diminish some of their self-inflicted and our real-world problems?

At this point in the ‘digital revolution’, it’s worth reminding ourselves of the many unresolved ‘bread and butter’ issues – taking the shine off what has been achieved. Too many remain unable or unwilling to get closer to the ‘what good looks like’ model we all keep talking about.

Pockets of pioneering HLS have over the last 7 years successfully notched up a range of use cases that exploit several of the core components of Web3, in all but name – the loose reference to it as the next evolution of the internet doesn’t do justice.

There’s a lot of hype surrounding Web3 at this point, with the wide range of accompanying definitions only adding to the confusion.

But this is far from a fad. And in my view, the HLS community is one of the verticals that can build a solid business case to embed many of its core concepts.

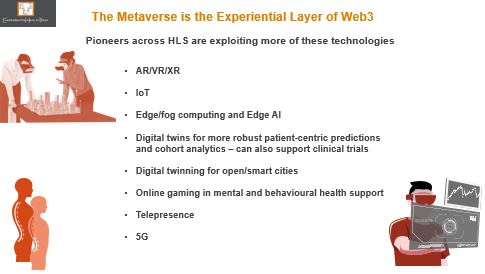

The Metaverse | So Near Yet So Far for HLS

The metaverse has already passed the ‘so what’ test among pioneering providers and life sciences organisations, with deployment in the field for some 7 years now.

Investment has been made across a range of hybrid novel settings: to explore; test & validate; benchmark; educate; and move beyond our legacy ‘one size fits all’ intervention model.

Yet today’s installed base is only really scratching the surface in terms of what could be delivered. Most likely is that exploration and uptake of these sub-components will continue to be incremental, while operational and clinical models continue to reconfigure, evolve, and mature. And let’s be clear, no-one is waiting for 5G to drop before they set out along this path.

The real sustainable benefit of Web3 will come from the bringing together of these ‘proven’ elements, along with others yet to be fully explored.

What Exactly is Web3

Web3 ultimately isn’t so much about the technology implemented, but the art of the possible. It provides a platform through which to pragmatically and simultaneously resolve many of today’s challenges – especially those cultural ‘brick walls’. To quote Sun Tzu from ‘The Art of War’: “Supreme excellence consists of breaking the enemy’s resistance without fighting.”

Alongside the metaverse, blockchain and tokenisation has been making inroads within pockets of HLS – although at a comparatively slower rate. For good reason however, and my view is that the grounded pragmatic examples coming through here will help to convince other cautious or sceptical peers of its validity.

But to my mind the two greatest jewels in the Web3 treasure chest are DAOs and synthetic data. Hand in glove, they offer those within the HLS community the first real opportunity to get ahead of the innovation and discovery curve, instead of chasing their tails.

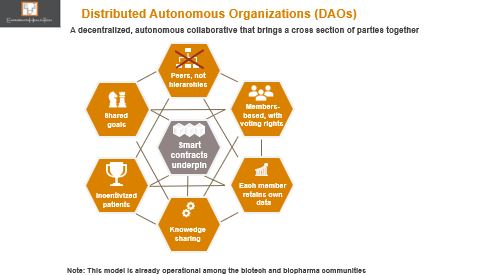

DAOs are the Wrap Around to Web3’s Success

With the interoperability war raging against many of you incumbents right now, and serious efforts to get more HLS stakeholders to collaborate, while pressure mounts to redesign the patient engagement model, Decentralised Autonomous Communities (DAOs) could really strike a chord.

I view DAOs as a more formalised type of the Trusted Research Environment model that’s being actively encouraged within some of the pioneering health systems. DAOs by nature will offer greater scope to integrate a broader range of stakeholders into a community of practice: removing so many of the barriers and uncertainties on how to progress together, within tightly governed parameters. DAOs will add to rather than derail effort to collaborate, and will help to see the wood from the trees in settling clear obtainable goals.

More meaningful relationships could also be nurtured with patients, who, encouraged by the open door a DAO membership offers, would be more likely to sign up and fully participate.

All you health tech incumbents should note that you too can play a meaningful role here. Those among you whose work straddles providers, medtech, and/or life sciences will have more options to consider over the longer-term.

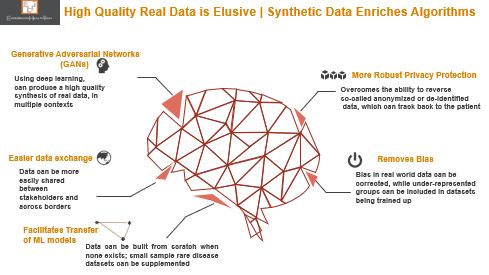

Access to Real World Data is Limiting | Let’s Synchronize

Nearly every conversation across HLS these days involves data – what good data looks like; where to get hold of it; how to exploit it for insight; who owns it; how biased it is.

We’re all aware of the many contexts and settings across the HLS landscape where a data strategy is not a leadership priority or capability; where good data isn’t being captured; where good data is being hoarded; where analytics skills are poor.

The more HLS matures, the more leaders realise they need good data. We’ve now reached the tipping point on fit-for-purpose data. The outstanding challenges in basic data capture and accessibility leave us no nearer to population health.

Enter synthetic data.

And yet the proven benefits from the field in creating synthetic data, if more widely understood and deployed at-scale could be a seismic catalyst for positive change across so many fronts.

Already being used in pockets of life sciences to bolster trials, it’s gaining momentum as a safe accelerant for predictive care. It’s accredited with the same statistical and business value as data collected in the field, or to supplant when real data isn’t available, or when such data is scarce, yet it carries no risk of being traced back to the real source.

One of the most obvious and potentially far reaching use cases will be in the field of digital twins: creating synthetic (proximal) data to mimic certain characteristics of a person, and use this as a blueprint to create a generic model that can be applied in other context.

Web3 could help generate a completely new data continuum, a gift that would keep on giving, locally and internationally.

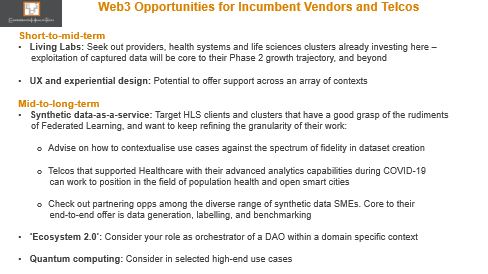

Health Tech Vendors Must Start Planning Now to Support Web3

Yes, Web3 is in its infancy, but it points to a solid opportunity for incumbent vendors and telcos to pursue beyond hyped ‘trends’. That’s why it makes sense for you to get involved in some way at this grass roots level, and identify your entry point.

I’d advise you start planning for this alongside your Business-as-Usual. Because not only will it determine some of your future customers; it will also clarify how you’ll need to upskill your teams; the new types of partnerships to invest in; the lines of business to add; new incentive programmes.

New Web3 competitor types are emerging, not necessarily familiar with HLS. Closer to home, those currently stealing a march are cloud leaders with an HLS footprint, biotechs, and the new breed of health tech bellwethers – culturally geared to operate in ‘future-ready’ mode.

But this is not a gold rush – your effort will deliver both short and intermediate wins while Web3’s infrastructure matures, and momentum builds.

There are also several weak aspects of the model that could dilute the core mission of Web3, to honour the voice of diversity – see below. In most of these areas, an answer lies in your hands.

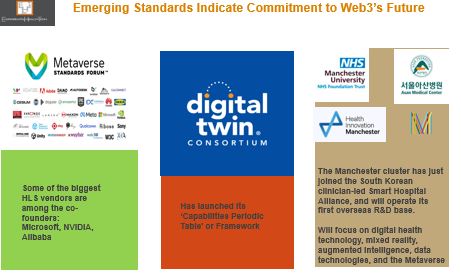

And if you’re unsure or sceptical at this stage, check out below the growing list of names coming together to form Web3- and related standards consortiums.

The Bottom Line: Interoperability is all over the Web3 value proposition. If you’re not already making moves to at least commit to this in the day-to-day, then this ship will pass you by.

Using Health Data for Research and Analysis | The Ben Goldacre Review of the NHS

The just-published review, “Better, Broader, Safer” relates specifically the NHS and its technology and HLS partners, but it’s equally applicable to every other entity across the data ecosystem that wants a working or commercial relationship with the NHS – the start-up community, telcos, social care, and private healthcare. In one way or another, all these relationships are bound by a need to share existing data and generate new data and forge insight.

Many of the widely respected author Ben Goldacre’s recommendations are already (independently) being applied in pockets of Europe and the US.

Citizen Scientists in Healthcare | The Bridge to Precision Medicine

Democratisation Accelerates Discovery

True patient-centricity remains an aspiration. We agree that patients still get a raw deal. And we know that despite some effort, the disconnect between how health systems and Pharma view ‘centricity’ versus those living with chronic health remains wide. Patient advocacy groups are under-utilised. Telehealth is being pushed as a catch-all model, and in the wrong context.

Patients have always been ahead of the curve. Many know the value of their data and are comfortable sharing, in what they feel is the right context. Savvy health tech companies – such as HealthUnlocked (Corrona), PatientsLikeMe, and PatientsKnowBest – have successfully harnessed the power of the direct collaboration model, also proving that patients are open to consenting access to Pharma and HCPs to secure anonymised data, for a fee.

Citizen science goes way beyond this.

Continue reading “Citizen Scientists in Healthcare | The Bridge to Precision Medicine”