The race among vendors to offer Generative AI may look like commercial FoMO. But within Healthcare and Life Sciences (HLS) a measured modest approach is unfolding.

Continue reading “Generative AI in HLS | Open to Interpretation”Retail Pharmacy’s Transformation and the Foothills of AI

Once outliers, incumbent US retail pharmacy chains have spent the last 6 years manoeuvring into position as the lynchpin for the Quadruple Aim.

Given the complex make-up of the US Healthcare system, this has been no mean achievement, and should be applauded. Yes, the market is large enough to keep attracting new players looking to disrupt primary care, such as Babylon Health. But Retail Pharmacy already enjoys a solid footprint across all US States, with a rich heritage of customer loyalty.

Its leaders have evolved to the point where advancing deeper into the Healthcare stack with a well-rounded primary care offer makes so much sense.

Transformation and the Order of Competitive Play

We talk about Transformation, Digital Transformation, and Disruption as if organizations are hard wired to know when and how to ‘do’ this.

The Retail Pharma sector is transforming and disrupting, with success stories to share. Its leaders have always understood that:

- They as incumbents must disrupt beyond their installed base of customers. They haven’t deviated from their core mission – to support under-served communities – yet their strategic announcements through 2022 align to the fact that so many more US citizens fall into this category of ‘unsupported at different stages of their wellness and health;

- Disruption generates growth – ‘going digital’ doesn’t;

- To disrupt, you first have to define your future today, despite market uncertainties and flux, and prepare every area of your business to pursue this. This may seem counter-intuitive, but by using insight to keep track of headwinds and tailwinds, vision and strategy are better informed, and take out guess work or reliance on intuition.

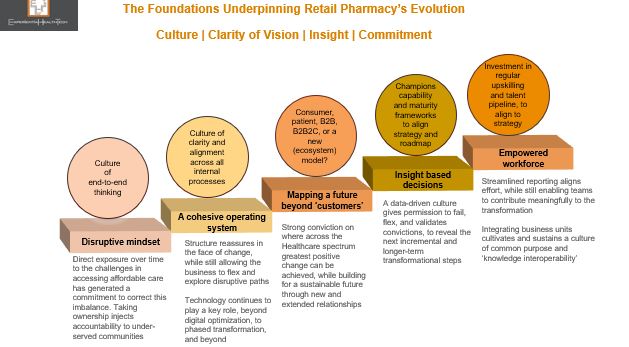

Culture| Clarity of Vision | Insight| Commitment

There are very clear characteristics that set successful companies apart, in any sector. Above all else, the old adage about culture still rings true. Culture is their compass, barometer, and altimeter all in one. Once an organisation agrees its vision and the scale of transformation needed to deliver, culture keeps leaders and the workforce aligned.

Successive Retail Pharmacy leaders within each of the leading 3 US players – CVS, Walgreens, and Walmart – honour these principles.

They are champions of end-to-end thinking: Setting a vision that extends beyond 10 years; being comfortable with not having all the answers up front, yet identifying the customer of the future they want to support, through new service models. Ironically, this mindset is interdependent on openness and evolution, where collaborative solution-building becomes the norm.

Transformation is by nature complex and can never be considered complete. Organisations need a balance of yin and yang to ensure structure and pace. That translates as driving through an internal operational overhaul, to ensure watertight efficiency. This in turn facilitates a meaningful value proposition for the market. In the case of Retail Pharmacy, all roads need to lead to value based care, underpinned by outcomes.

But there are cautionary notes:

- Given the installed bases at stake, at-pace scaling mustn’t compromise patient safety. Some investigative reports in the US (outside my remit) claim intense KPI metrics have led to multiple cases of prescribing admin errors. As Europe (currently a digital laggard) gears up for ePrescribing, this aspect will be scrutinised. Trust is precious;

- Both Walgreens and Optum Group (now a partner of Walmart) claim to be payor agnostic and champion equity, but have yet to truly reset the status quo on transparency and out-of-pocket expenses. Meanwhile, note the growing momentum behind the much smaller @RosettaHealth and its evidenced framework, delivering eye-watering savings for members.

Insight is Our Oxygen Through Transformation

Insight, based on good data, validates effort when we see small and ongoing positive outcomes. It keeps an organisation’s workforce and partners close to its mission. Analytics and AI-driven insight is intertwined with Transformation.

Experiential HealthTech defines AI in today’s market context as Augmented Intelligence. This not only reflects the capability maturity across Healthcare – embryonic – but also re-enforces that AI will remain a blend of machine and human interaction. This is vital across Healthcare, which needs to keep high touch contexts- as far as resourcing permits.

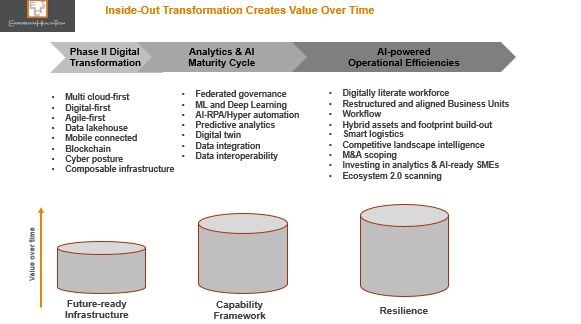

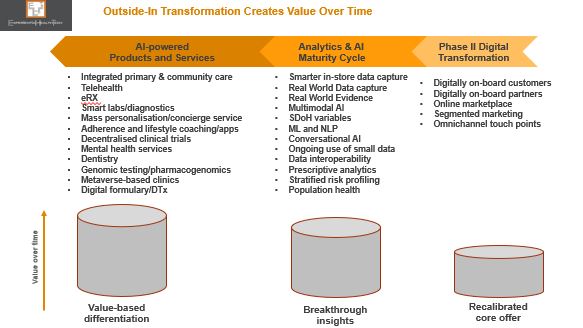

The analytics and AI maturity cycles at operational and market-facing levels are broad, and the pace and scale at which Retail Pharmacy organisations are working through these are dictated by their internal reconfigurations and partnerships.

Throughout the COVID pandemic, one thing became clear: there were petabytes of untapped rich data across Retail Pharmacy. And like other organisations already on a transformation path, radical effective responses could be accelerated, with confidence.

This success will likely have altered Retail Pharmacy incumbents’ next phase priorities: while a degree of competitive overlap remains across their roadmaps, there are also liberal doses of ‘dare to imagine’, with ambition flagged against decentralised clinical trials and pharmacogenomics.

Technology and Digital Blend

Tech partnerships have proved and remain invaluable to Retail Pharmacy. The collaborations being signed, to ensure ongoing enterprise and analytics/AI maturity, showcase how some ‘big’ players are comfortable carving a future-state based on value-driven partnerships and knowledge sharing, rather than ‘fixing’ Healthcare with a land grab. Nor are these retailers insisting on exclusivity – Microsoft, for example is supporting more than one with their ongoing transformation.

These are just some of the few currently supporting the sector.

Healthtech SMEs and AI

SMEs in the form of biotechs, virtual care , and digital therapeutics specialists are contributing significantly across Healthcare. Some embed analytics and other AI modes as a competitive differentiator from Day 1. Many haven’t even started along this road. And yet they must, because we need to end up with SMEs that are part of a wider contribution to society, supporting real world need, workflow and other processes. Point solutions help no-one.

For that reason, the interlinking internal and market facing transformation phases outlined above are just as relevant for them.

Retail Pharmacy leaders’ vision does include greater collaborative SME ventures, but for the moment risk is largely managed and weighted within VC funding, or support to modernise the SME operation as a future-proof.

As their market facing services portfolio continues to evolve and augment the Healthcare-at-Home vision, I expect to see a wide range of SME-related announcements:

- CVS, for example, continues to back analytics and virtual care specialist Biofourmis (Series D) – and so a multimodal AI focus may yet emerge to align with CVS’ direction.

- In India, Walmart is training 5,000 micro and SMEs (micro enterprises are the backbone of the Indian economy) over a 5-year period. Participants will have access to advanced business tools and advisory support to grow their offline and online businesses. There is an additional potential to advance and gain accreditation through the Walmart marketplace.

This isn’t about conquering: it is about broadening the spectrum of affordable choice, equity, and bridging more of the chasms across the Healthcare system, to enhance local population health. Good data and the power of outreach will remain critical levers. (smaller) Peers elsewhere can copy aspects of this model to start out on their own Transformation.

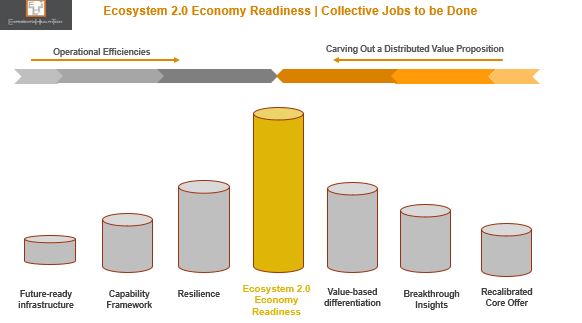

The Ecosystem 2.0 Economy Beckons

I believe the greatest breakthrough in the US initially will come from a willingness to forge a new model – based on Ecosystem 2.0 – which as composite organisations these 3 US players could orchestrate or contribute to, when the time is right.

In the meantime, the new relationships being forged with payors and their provider networks, Pharma, and SMEs bode well.

From Happify to Twill | A Masterclass in Patient-Centricity

Attempts to be ‘patient centric’ still elude many practitioners across Healthcare.

Ironically, it’s the new breed of health tech bellwethers that have grasped patient-centricity (PX) from the outset, and kept it core to every aspect of their mission.

One such exemplar is Happify Health, one of 6 companies I highlighted in my 2022 Trends report “The Year of Purpose-Led Convergence | Vendor Watch List”. From a range of backgrounds, these have been selected for their marked capability to lead and converge with purpose, beyond their core. They have not only recognised the cracks in the current system, but are moving to bridge these through novel approaches. Also recognising that rigid adherence to the status quo impacts on bottom line, relevance, and relationships, they are comfortable working across frontiers.

Here’s what I wrote:

“Happify Health: An evidence based DTx (digital therapeutics) specialist, which has gone from strength to strength within the mental health sector. Heavy investment over the years has enabled it to truly understand buying personas and channels, and to design a portfolio to meet these respective needs. Its platform now supports +50 medical devices and multiple apps.

But here’s the thing: not content with designing a broad portfolio to accommodate varied demand cases, it is now prepping to support acute chronic care instances which trigger mental health problems. There is a significant chasm to cross here, and what it’s proposing excites me.

Happify is also fluent in ‘Ecosystem 2.0’ thinking.” – as defined by Experiential HealthTech.

And so, I’m not surprised about the next chapter, marked by its transition to @Twill.

Simply Experiential™ | Twill in Motion

The birth of Twill consolidates its progress over the last 5 years – expanding from D2C to B2B, and the launch of its prescription DTx range – while signalling its ambitious next 5-year plan: to map deeper into an individual’s treatment cycle to offer as bespoke a range of interventions as possible.

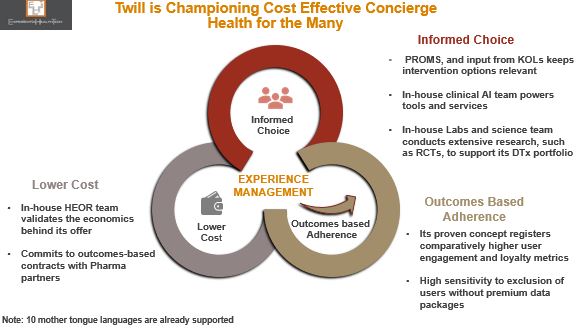

Why is this important? Happify has, with scientific evidence, successfully brought together more service components than many of its peers. PX is its DNA: near real-time PROMS data moves with the patient to inform decisions – it has successfully proved that much of the time (but not all), it is possible to circumnavigate the EHR and still exploit new rich data. Individual service users gain directly through deeper engagement and informed choice.

Equally importantly, Twill’s leadership is demonstrating the balanced equation of outcomes-based adherence and lower cost to health systems, Pharma, and payers alike – KPIs with which all Healthcare stakeholders continue to grapple.

There are four new inter-related components which will uphold its future direction.

The launch of Sequences™ | One Step Closer to Personalised Care

The trust placed in Twill by the Healthcare, Life Sciences, and payor communities has resulted in Sequences™, its “end-to-end digital framework”. This translates as a range of modular service options, to reflect the many support contexts typically out of scope among these Healthcare stakeholders, since they’re not operationally geared to configure at this level: evidence-based DTx, well-being products, peer communities, a multi-disciplinary clinical team, and coaching; quick reference, initial diagnosis, short-term and/or longer-term support.

An additional attraction to the partners that have signed up to this is the strong collaborative and co-design foundations on which Sequences is built – providing them with a gateway to new receptive patients and citizens, which have already independently formed trusted relationships with Twill.

But Twill’s biggest differentiator is that it’s one of the few working at the intersection of mental health and acute comorbidity. This is so important, and it’s more than frustrating that more organisations aren’t acknowledging this as ‘the problem we need to solve, together”.

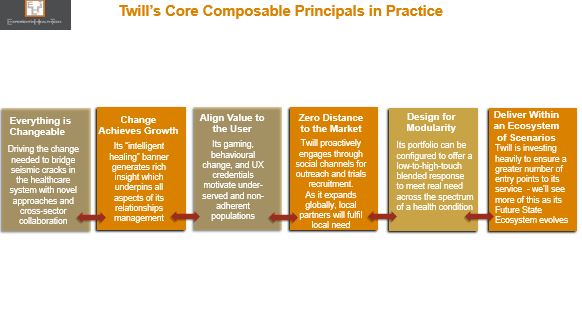

A Look At Twill’s Guiding Composable Principles

Delivery of this model isn’t easy. In my view, Twill has incrementally moved into this position of strength by operating as a composable organisation in all but name. These principals truly embody patient centricity and move way beyond lip service to PX, to deliver a radically improved experience for those living with a chronic condition which is also impacting their mental health.

There are 6 overarching components of composability, which define an organisation’s relationship with its clients and partners, and which form the foundations of the incremental steps they take towards Ecosystem 2.0.

The leadership culture driving composability is the realisation that we achieve more together. Twill is clear that it will not strive to design every solution inhouse, but will happily bring in third party expertise, either directly, or to accommodate third parties already deployed within its B2B client base.

But this will be no loose amalgamation of products. Twill’s portfolio is already of a high enough calibre today to attract complementary third parties, recognising not only the valuable network effect of its open (API-driven) platform, but also the potential of a more rewarding future: migrating away from point solutions to offer a model that not only resonates with service demand gaps, but also chimes with the new forms of clinical workflow and patient flow that we’re crying out for.

That is why Experiential HealthTech classes Twill as an Ecosystem 2.0 orchestrator.

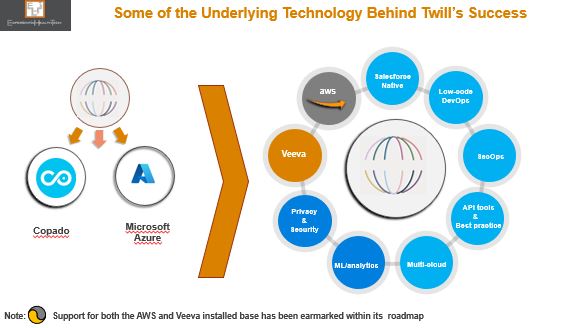

Ecosystem 2.0 with Twill in Outline

The model outlined below reflects where Twill is today (Layers 1 &2), and how potentially it could start to orchestrate its ecosystem (Layer 3). What’s exciting is that new ecosystem members will also steer, contribute to, and govern this future cross-sector state.

Localised members will also respond to local need, and help to accelerate the rate at which Twill can scale, globally, as is clearly its intention.

Federations of secure data exchange

With the permission of its service users, Twill has already built up an enviable rich data set. As its ecosystem grows, the potential to incrementally enhance its clinical AI base is immense – evidence garnered from clinical trials alone, to steer prescription therapeutics, is exciting.

But this is a two-way street. All ecosystem members must commit to Twill’s federated data underpin. Outcomes data from referrals to third parties must be shared back with Twill – to monitor response rates to this intervention, but also to enable Twill to suggest alternative treatment if low outcomes are registered. All of this data creates a SVoT (single record) per service user, and bolsters Twill’s longitudinal system of insight. Population cohort support is also planned.

Below is a snapshot of some of the technology investment Twill has committed to. And of course this carries the potential to augment its reach. You can see how this lends itself to Ecosystem 2.0.

This is the future. Not for all of us. But for very many. Experiential HealthTech looks forward to seeing what emerges next from Twill.

Larry Ellison | Healthcare’s Misplaced Hero

Larry Ellison has had plenty of time to mull over his ‘Future of Healthcare’ proposition, unveiled this week. He’s drawn on Oracle’s solid relationship with 28 of the top 30 global life sciences leaders, its support of some big name providers and US payors, and how it threw its weight behind some pioneering collaborative discovery through the pandemic.

And yet, he’s somehow managed to miss the mark.

Continue reading “Larry Ellison | Healthcare’s Misplaced Hero”Nokia and Equideum Health Create New Dimensions with Blockchain

I’ve been lukewarm to the blockchain push in Healthcare, and sceptical on its positioning as a gateway to interoperability.

Despite some success, we’ve not seen anything like the groundswell projected. Was blockchain considered a step too far, or a nice to have ‘icing on the cake’ when in reality the cake hadn’t yet been baked?

And yet, Q1 2022 has been marked by a few noteworthy alliances – looking at the bigger picture through a pragmatic lens, without sensationalism.

‘Noteworthy’ given the names involved. One is Nokia (with its Bell Labs R&D arm) and Equideum Health – formerly blockchain specialist ConsenSys Health, led by the experienced Heather Leigh Flannery, ex-Hashed Health.

Today it’s at pre-launch stage, initially US-focussed, so I’ll return as it evolves, as I still have questions.

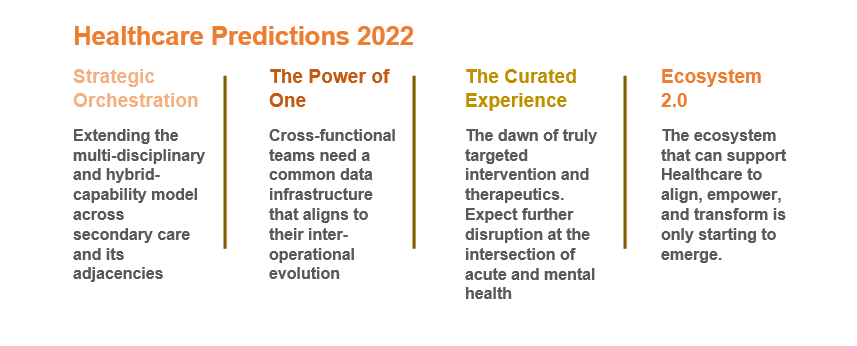

Continue reading “Nokia and Equideum Health Create New Dimensions with Blockchain”2022 | A Year of Purpose-Led Convergence

These are my top 4 predictions for the Healthcare sector in 2022.

Each contributor to this sector has to finely balance rigour and quality of service with a more agile, rapid response to market dynamics, while positioning against some form of innovation.

We all know the challenges, and can pinpoint the bottlenecks and backlogs. But we’ve also collectively acknowledged that having to embrace such high-risk stakes over the last 2 years has unleashed a pioneering spirit, that has not only dismantled boundaries, but illustrated that cross-disciplinary groups with a shared purpose can move mountains – paving the way for a multi-pronged approach to tackling some of Healthcare’s greatest challenges.

And of course, technology remains the critical enabler.

Continue reading “2022 | A Year of Purpose-Led Convergence”Citizen Scientists in Healthcare | The Bridge to Precision Medicine

Democratisation Accelerates Discovery

True patient-centricity remains an aspiration. We agree that patients still get a raw deal. And we know that despite some effort, the disconnect between how health systems and Pharma view ‘centricity’ versus those living with chronic health remains wide. Patient advocacy groups are under-utilised. Telehealth is being pushed as a catch-all model, and in the wrong context.

Patients have always been ahead of the curve. Many know the value of their data and are comfortable sharing, in what they feel is the right context. Savvy health tech companies – such as HealthUnlocked (Corrona), PatientsLikeMe, and PatientsKnowBest – have successfully harnessed the power of the direct collaboration model, also proving that patients are open to consenting access to Pharma and HCPs to secure anonymised data, for a fee.

Citizen science goes way beyond this.

Continue reading “Citizen Scientists in Healthcare | The Bridge to Precision Medicine”Smart Healthy Cities | A Welsh Exemplar

Sustaining Our Communities Through Networked Wellbeing Villages

It’s a bold promise to offer personalised, preventive, integrated healthcare & wellbeing within a socially cohesive community. The Welsh regenerative project, Pentre Awel, aims to deliver.

Unlike projects such as Saudi Arabia’s NEOM City, this is tailored to supporting the local community’s needs- high deprivation, unemployment, an ageing population, and chronic co-morbidity. Geared to be high-tech and high-touch, participatory care, shared facilities, and telemedicine will be standard.

Continue reading “Smart Healthy Cities | A Welsh Exemplar”